WHY TREDS IS DESIRED FOR PROFESSIONALS LIKE VALUERS

AUTHOR: ER. NALIN TAYAL

TReDS is an electronic platform facilitating the financing/discounting the Trade receivables of the Micro, Small and Medium Enterprises (MSMEs) through multiple financiers. This scheme was introduced by RBI to meet the liquidity crisis of the MSMEs by providing a mechanism for financing their trade receivables. According to RBI, the TReDS would ‘facilitate the discounting of both invoices as well as bills of exchange.’ This way, MSME sellers, corporate buyers, and financiers (banks and NBFCs) would be linked on a common platform. After approval from both the seller and the buyer, the financiers would bid on invoices and make the payment to the seller. The process to join any of the TReDS platforms is short and quick.

Background

Micro, Small and Medium Enterprises (MSMEs) are the back bone of Indian Economy and despite the important role played by them in the economic fabric of the country, continue to face constraints in obtaining adequate finance, particularly in terms of their ability to convert their trade receivables into liquid funds. In order to address this pan-India issue through setting up of an institutional mechanism for financing trade receivables, the Reserve Bank of India had published a concept paper on “Micro, Small & Medium Enterprises (MSME) Factoring-Trade Receivables Exchange” in March 2014.

Based on the public comments received on the concept paper and the subsequent draft guidelines issued for setting up and operating the system, and interactions held with relevant stakeholders, the following guidelines are being issued for setting up and operating the trade receivables system in the country. These Guidelines are issued by Reserve Bank of India under Section 10(2) read with Section 18 of Payment & Settlement Systems Act, 2007 (Act 51 of 2007).

Why TReDS is desired for Professionals like Valuers?

The scheme for setting up and operating the institutional mechanism for facilitating the financing of trade receivables of MSMEs from corporate and other buyers, including Government Departments and Public Sector Undertakings (PSUs), through multiple financiers will be known as Trade Receivables Discounting System (TReDS).

The TReDS will facilitate the discounting of both invoices as well as bills of exchange. Further, as the underlying entities are the same (MSMEs and corporate and other buyers, including Government Departments and PSUs), the TReDS could deal with both receivables factoring as well as reverse factoring so that higher transaction volumes come into the system and facilitate better pricing. The transactions processed under TReDS will be “without recourse” to the MSMEs meaning that MSME vendors need not be responsible for non-payment of the trade receivables amount (from buyers)

Section 15 of MSMED Actdefines that MSMED Act is applicable to both supplier of goods &supplier of services. It is a misconception / myth that MSMED Act and TReDS Platform is applicable only to supplier of goods.

CURRENT PRACTICES:

- Customer (A) issues supply order / job order to a vendor (B).

- Vendor(B) supplies goods / services to customer (A)

- Vendor(B) is at the mercy of customer(A) for payment

- MSMED Act 2006 defines the payment terms to be restricted to 45 days of the supply of goods / services.Refer section 15which reads as under:

Liability of buyer to make payment.—Whereany supplier supplies any goods or renders any services to any buyer, the buyer shall make payment therefor on or before the date agreed upon between him and the supplier in writing or, where there is no agreement in this behalf, before the appointed day:

Provided that in no case the period agreed upon between the supplier and the buyer in writing shallexceed forty-five days from the day of acceptance or the day of deemed acceptance.

TReDS / BILL DISCOUNTING / FACTORING MECHANISM

- Customer on-boards one or all three TReDS Platform existing in the Country.

- Customer advices it’s Vendors to on-board the TReDS Platform

- Upon registration, the vendor (B) post / upload the receipted invoice against the supply of goods / services at TReDS Platform, upon which the interested financers (FI / Bank / NBFC) submit their quotes.

- The vendor has the option to choose the financers and enter into an agreement with the financer and the customer.

- The financer upon receipt of receipted invoice and agreement, releases (say 80%) to the vendor (B)

On due date i.e. maximum 45 days, the customer releases payment to financers and financer release the balance payment (after deducting already paid + interest) to the vendor.

Problem Faced By Professionals Likes Valuers

Majorly valuers are engaged in providing services to private and public sector undertaking, out of which majorly are from banking industry. Many Valuers are oftenly complaining about

- Delay in Payments

- Negotiation subsequent to deposit of invoices

- Harassment and humiliation after doing the job in the hands of officers of the customer (Banks).

It is ironical to note that the Banks which themselves are engaged in factoring business, desist / refrain from factoring the invoices of their service providers.

The communication with RBI is enclosed herewith for ready reference of all

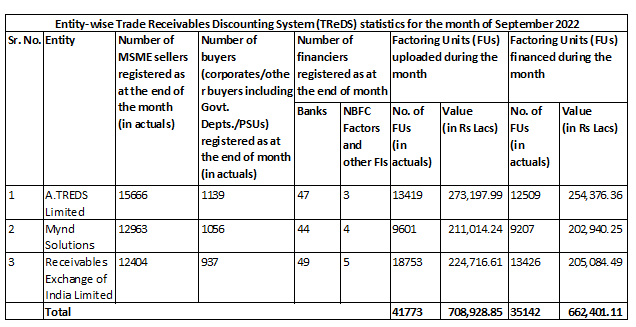

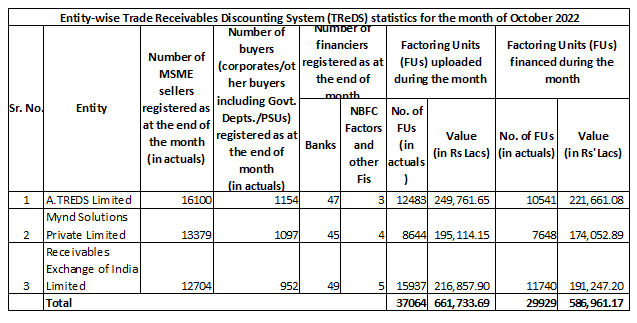

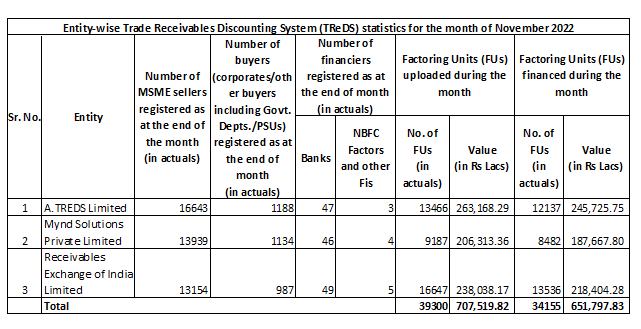

Pertinent to mention here is that various TReDS Platfoms are enabling the factoring of invoices pertaining to supply of goods and services at a very good scale on month to month (M2M) basis, the gist to same is as under .

What Valuers can do?

- Valuers can emphasis there service taker / customer / bank to onboard TReDS, so that they can also onboard TReDS Platform and get their bills discounted to ease out / get rid off the menace of delayed payments / negotiations / humiliations / harassments

- Emphasis the associations for the needful.

CLICK BELOW TO READ MORE DETAILS

ABOUT THE AUTHOR

ER. NALIN TAYAL

BE – Mechanical(Hons.), M.E – Production, M.B.A- Finance, LLB

TO READ MORE ABOUT THE AUTHOR CLICK BELOW