IN BUDGET 2023-24: PAN CARD TO BE SET AS SINGLE BUSINESS IDENTITY

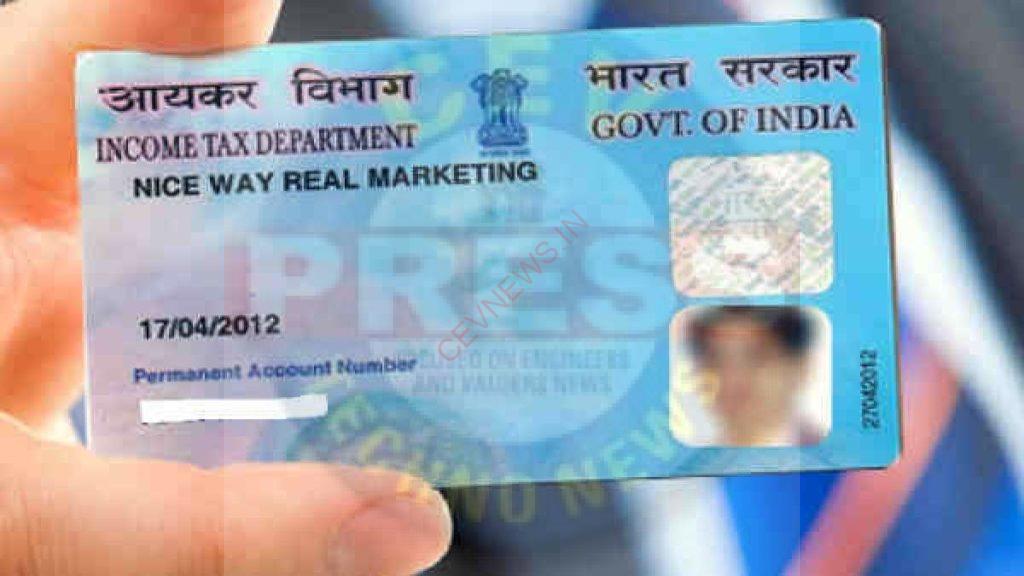

The upcoming budget could include a legal framework that mandates the use of the Permanent Account Number (PAN) as the sole business identification for all processes. According to the Business Standard, Budget 2023 may include a provision to link a person’s or entity’s PAN card to their multiple existing identifications in order to streamline processes.

Currently, businesses in India are required to obtain several different identification numbers for various purposes, such as registering for taxes, obtaining a loan, or opening a bank account.

The PAN, which is already used for tax purposes, is now being considered the sole business identification number to streamline the process and increase efficiency.

The PAN, a 10-digit alphanumeric number issued by the Income Tax Department, is currently mandatory for individuals and entities to file tax returns and conduct financial transactions above a certain threshold. With this new development, PAN is likely to be used as a single identifier for businesses across different areas of compliance.

“More and more arrangements are being made to reduce the multiplicity of the KYC process. This step (single identity) leads to single KYC for availing of multiple services in one place,” the report noted.Further, the mapping and linkages with PAN ensure coherence in the KYC requirement among different government bodies.

According to the report, that cites a senior finance ministry official, an enabling provision or clause may be introduced in the Finance Act, 2023, ensuring the “legal backing” for PAN being used as the primary identifier of an entity.

The provision will also ensure the mapping of PAN of an entity with multiple existing identifications. Accordingly, it will be notified under various central and state legislations, said the report, adding that currently, there are about 20 different identifiers at both the central and state levels.

This is likely to benefit investors because they will no longer have to fill out multiple forms of identification for the National Single Window System for project-related clearance and approvals.it will benefit small and medium-sized businesses (SMEs) the most, as they frequently struggle to navigate complex compliance requirements and obtain multiple identification numbers.

The use of PAN as a single business identification number is also expected to improve transparency and accountability in the Indian business landscape. With a unique identification number for each business, it will be easier to track and monitor compliance with various laws and regulations, reducing the scope for tax evasion and other fraudulent activities.