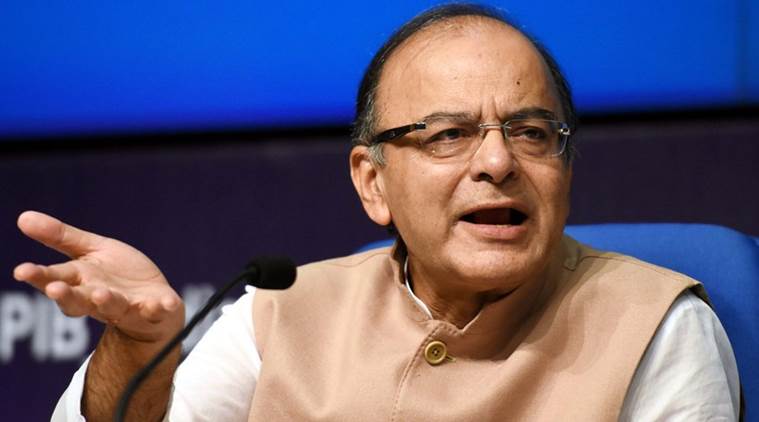

In written reply to a query in Lok Sabha, he said India has emerged as a safe haven for investors around the world. “Government has assessed the impact of Brexit on the Indian economy. Thus far, India has not only avoided adverse impacts, it has in fact emerged as a safe haven for investors around the world…By virtue of its domestic policies, India is seen as a haven of stability and opportunity in these turbulent times,” Jaitley said, according to a statement issued by the finance ministry.

He said the government, the Reserve Bank of India and the Securities and Exchange Board of India are keeping a constant vigil on the global developments with a view to protecting interest of investors.

Sebi has laid down various regulations and guidelines for protecting investors’ interest and ensuring orderly functioning of the stock market, he said.

“While the government and the RBI are closely monitoring the situation, India’s macroeconomic fundamentals are strong. Besides, the strong forex reserves position can provide a buffer against any temporary episodes of volatility in the domestic foreign exchange market,” he said.

The minister said that Brexit may have some impact on India on the trade, but that could be offset by lower international crude oil prices.

India’s goods exports to the UK and the EU (including UK) have been around 3 per cent and 17 per cent of our total exports, respectively.

India also exports roughly $10 billion in software to both the UK and EU. Overall though, India’s exports to both the UK and Europe have been on a downtrend in the past two years on account of subdued demand led by a frail and scattered recovery in the region.

Besides, the International Monetary Fund has also revised downward its forecast of global growth from 3.2 per cent to 3.1 per cent in the aftermath of UK’s exit from the European Union, widely known as Brexit.

“However, these potential effects on India’s growth could be offset by the weaker price of oil, which will help maintain macro-stability, and by the likelihood of more policy support in the advanced economies. Moreover, the impact of Brexit on trade, if any, in the medium term, would also depend on bilateral trade negotiations that will determine India’s future market access to these countries,” he said.

Speaking on the performance of Indian financial markets immediately after the Brexit annoucements, he said the rupee depreciated against the US dollar by around 1 per cent for one day post-Brexit referendum while currencies of other emerging markets depreciated for many days.

Besides, the Sensex fell only on one day by 2 per cent while the equity index of many other developed and developing countries fell by a higher percentage for many days.