PROFITABILITY INDEX-ALL YOU NEED TO KNOW

The profitability index measures the monetary benefits (i.e. cash inflows) received for each dollar invested (i.e. cash outflow), with the cash flows discounted back to the present date.

More specifically, the profitability index ratio compares the present value (PV) of future cash flows received from a project to the initial cash outflow (investment) to fund the project.

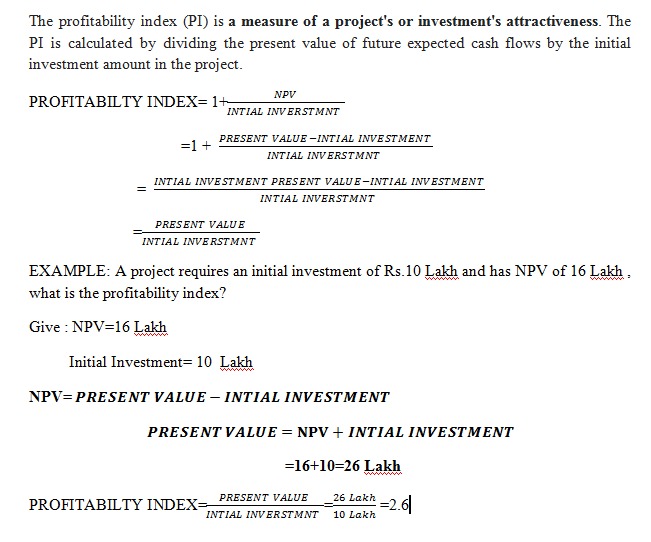

The profitability index (PI) is a measure of a project’s or investment’s attractiveness. The PI is calculated by dividing the present value of future expected cash flows by the initial investment amount in the project.

PROFITABILTY INDEX= 1+NPV/(INTIAL INVERSTMNT )

=1 + (PRESENT VALUE-INTIAL INVESTMENT)/(INTIAL INVERSTMNT )

= (INTIAL INVESTMENT+ PRESENT VALUE-INTIAL INVESTMENT)/(INTIAL INVERSTMNT )

=(PRESENT VALUE)/(INTIAL INVERSTMNT )

EXAMPLE: A project requires an initial investment of Rs.10 Lakh and has NPV of 16 Lakh , what is the profitability index?

Given : NPV=16 Lakh

Initial Investment= 10 Lakh

NPV= PRESENT VALUE-INTIAL INVESTMENT

PRESENT VALUE=NPV+INTIAL INVESTMENT

=16+10=26 Lakh

PROFITABILTY INDEX= (PRESENT VALUE)/(INTIAL INVERSTMNT )= (26 Lakh)/(10 Lakh) =2.6