UK house prices fell unexpectedly in July, signaling a loss of momentum in the housing market after a tax break on purchases began to be phased out.

The average value of a home fell 0.5% to 244,229 pounds ($338,800), the first decline in four months, Nationwide Building Society said Wednesday. That followed an average gain of 1.6% between April and June. The annual pace of increase slowed to 10.5% from a 17-year high of 13.4%.

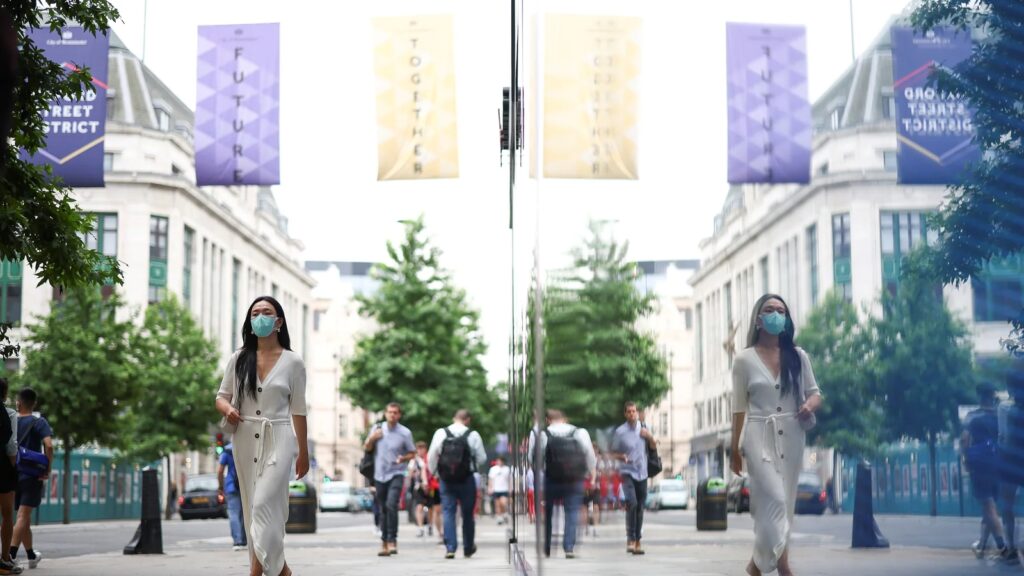

The figures represent a return to more normal conditions after a frenzied first half that saw the housing market defy the worst economic slump in more than 300 years. Demand was driven by the prospect of thousands of pounds of savings for purchases completed by June 30 and a pandemic-induced quest for homes with more space away from built-up urban areas.

On July 1, the stamp-duty threshold was lowered by a half to 250,000 pounds, adding 12,500 pounds to the cost of buying a 500,000-pound home — the average house price in London. From October 1, the threshold will revert to 125,000 pounds.

Nationwide chief Economist Robert Gardner said underlying demand is likely to remain “solid” in the near term, underpinned by strong consumer confidence, low borrowing costs and a continued shortage of homes for sale persisted.

While record property values threaten to entrench economic divisions in the UK, Bank of England officials aren’t worried that the boom is leading to an unsustainable buildup of debt. In their latest financial stability report, they said mortgage-to-income ratios had risen only marginally.