If low sales, drop in project launches and rise in unsold inventories plagued the residential real estate market across the country in 2014 and the sector witnessed a decline on all fronts, a pick-up in the GDP growth rate, softening inflation and a cut in interest rates promise recovery for the sector in 2015.

A report by Knight Frank projects an overall rise in sales and prices of real estate across the country though the sector may continue to witness a decline in project launches on account of existing high unsold inventory.

How the markets fared in 2014

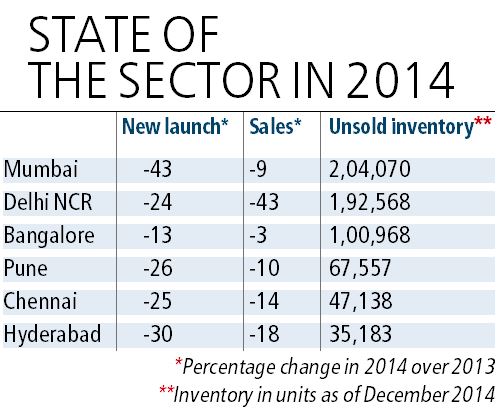

While the first half of 2014 saw the new launches and sales volume decline by 32 per cent and 27 per cent respectively over the same period last year, the second half of the year also continued to reel under pressure and even the festive season failed to enthuse the market and bring any cheer to the industry. The Knight Frank report titled ‘All India Real Estate’, that was released on Wednesday and that captures the industry’s performance in the second half of 2014 shows that the sales volume across six leading cities including Mumbai, Delhi NCR, Bangalore, Chennai, Hyderabad and Pune continued to decline and the number of launches in the second half fell by 22 per cent from 1.61 lakh units in H2 2013 to 1.26 lakh units in H2 2014. The H1 report had said that the situation may not reverse soon as the developers who had seen a fall in demand may practice caution while launching new projects.

In 2014 the sales volume across the six cities fell by 17 per cent from 2.84 lakh units in 2013 to 2.34 lakh units in 2014. New launches fell by 28 per cent from 3.72 lakh units in 2013 to 2.68 lakh units in 2014. If Delhi NCR was the worst performing market in of volume growth that fell 43 per cent, Mumbai witnessed the maximum drop in new launches and they fell by 43 per cent over the year-ago period. Hyderabad witnessed 30 per cent drop in new launches in 2014.

The slowdown visible in the first half of the calendar 2014 continued even in the second half and the unsold inventory continued to remain at high levels. While the inventory in Delhi NCR stood at 1,67,000 at the end of June 2014, it rose by another 15 per cent to hit 1,92,568 units at the end of December 2014 as a result of the fall in sales volume by 43 per cent in the second half of the year in the region. Mumbai, however, saw a marginal decline in inventory levels during the same period and the number of unsold units came down from 2,13,742 units in June 2014 to 2,04,070 units in December 2014. Over the last three years the unsold inventory in NCR has risen at a compounded annual growth rate of 15 per cent. The six major cities on an aggregate had a total of 6,47,484 unsold units at the end of December 2014.

While the market remained subdued in the second half of 2014, the residential real estate prices witnessed some recovery on the back of improved sentiments in the second half of the calendar 2014 on three factors — formation of a stable government, hopes of a cut in the interest rates and a revival of the overall economy.

The Micro market — NCR

Delhi NCR that witnessed a 43 per cent decline in sales in 2014 from 71,421 units in 2013 to 40,525 in 2014 is expected to take some time for full recovery. While it is the worst performance for the NCR region in a decade, the report predicts that it will take more than three years to off-load the unsold inventory. Within NCR, Noida and Greater Noida are the weakest markets as they account for the highest number of unsold inventory within the NCR market.

“In NCR the launches are likely to increase by 7 per cent in the January – June 2015 period and sales are expected to remain at 20,000 units, significantly higher than what NCR recorded during H2 2014 at 12,075 units,” said the report.

How the residential market will shape up in 2015

Though 2014 was a weak year for the industry as it faced stress on various accounts the year, the industry is expected to tread on the revival path in 2015. The report projects a 4 per cent rise in overall sales across the six major cities in the H1 2015 over the corresponding period last year. Even the pace of decline in new launches is expected to go down. The report projects that the decline in new launches in first half of 2015 will be around 4 per cent which is a marked improvement over the decline of 22 per cent in new launches in H2 2014.

“All eyes are now on the union budget — focus on affordable homes and infrastructure will expand volumes” said the report. The improved sentiment is also expected to result in pick up in prices. While Mumbai which has seen better absorption of existing inventory may see a price rise of around 10 per cent in H1 2015, Bangalore and Delhi NCR are expected to see a rise of around 3 and 2 per cent, respectively.