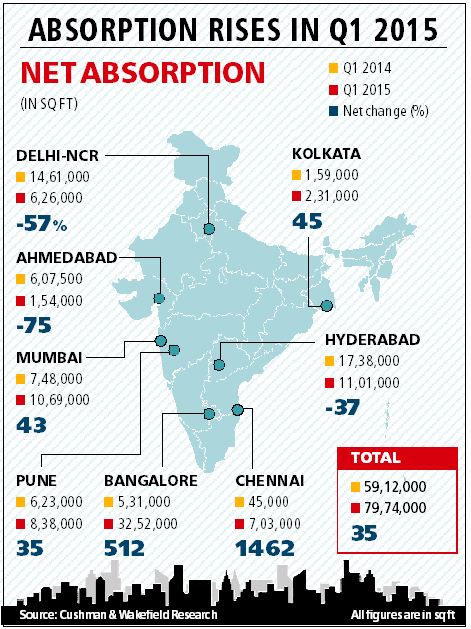

In an indication that shows buoyancy on growth expectations of companies in the economy going forward, a report prepared by real estate consultant Cushman & Wakefield shows that the quarter ended March 2015 witnessed net absorption of office space rise by 35 per cent to 7.9 million sq ft (msf) across the top eight cities of the country over the corresponding period last year.

However, while the absorption levels went up, the supply growth did not coincide with it and the industry saw new supplies declining by 2 per cent from 7.55 msf in the quarter ended March 2014 to 7.43 msf in March 2015.

Bangalore, Chennai lead but Delhi lags

The demand, however, is not uniform across geographies and while the biggest jump in absorption during the quarter was seen in Chennai and Bangalore as they witnessed growth in absorption by 1,462 per cent and 512 per cent, respectively, Ahmedabad and the Delhi NCR witnessed a decline in demand and the absorption levels slipped by 75 per cent and 57 per cent respectively.

The report points out that the rise in demand in the two major southern cities was on account of pick up in demand from the IT-ITES companies. In turn the demand for IT-ITeS is linked to the revival of US economy and the expected rise in demand for IT services from there.

In volume terms, Bangalore witnessed the biggest surge in demand and even as the fresh supply jumped by 1.9 msf, the net absorption stood at 3.2 msf and accounted for almost 40 per cent of the net absorption of 7.9 msf across the eight cities.

On the other hand Delhi NCR emerged as the weakest market in terms of drop in absorption in volume terms. While the net absorption stood at 1.46 msf in March 2014, it dropped to 0.62 msf in the previous quarter. In fact Hyderabad and Delhi NCR were the biggest markets in terms of volume of net absorption last year with Hyderabad being at the top with net absorption of 1.73 msf.

Even as the demand declined in the Delhi NCR region, the supply kept coming during the quarter and it rose by 26 per cent in the previous quarter over the corresponding quarter last year.

Delhi NCR also saw the maximum supply coming in during the quarter and it stood at 2.1 msf during the quarter.

The report points out that the decline in the NCR market is on account of delays in decision-making because the demand continues to remains strong from occupiers and there is a large number of transactions in the pipeline.

In fact a report prepared by the Cushman & Wakefield on the residential market in February said that the new launches in the year 2014 in the residential segment too declined by 12 per cent over that in 2013 and Delhi NCR witnessed a decline of 30 per cent that was only second to Hyderabad. In unit terms Delhi witnessed the biggest decline from over 38,000 new unit launches in 2013 to 26,800 units in 2014.

Mumbai, being an important market particularly in the office space segment, also witnessed a pick up in demand and the net absorption rose by 43 per cent from 7.48 msf in march 2014 to 1.07 msf in the previous quarter. On the new supply front, the Mumbai market witnessed a marginal increase of 4 per cent.

How it is expected to grow

Experts feel that the trend in net absorption of office spaces is set to rise on account of the government’s make in India push and an overall pick up in the economy.

“The trend will remain positive for 2015 backed by the overall economic sentiments of the country and a very strong push being applied by the government in creating a more business conducive environment. The resultant would be a stronger demand from the services and BFSI sectors. We expect to see a growth in the office space absorption approximately 15% by the end of 2015,” said Sanjay Dutt, executive MD, South Asia, Cushman & Wakefield. He further added that while a total of 36 – 37 msf should get absorbed by the end of 2015 in the office space, the majority of the demand would come from the IT/ITeS and the BFSI sector in key markets of Bangalore, Delhi-NCR and Mumbai.

The report points out that a lot of companies in Delhi-NCR, Bangalore and Mumbai are looking at expansion, consolidation in these cities for their core activities and therefore they are expected to see a steady increase in activities as against their immediate alternate markets like, Hyderabad, Pune and Chennai.

On the other hand cost benefits and increased availability of grade A spaces in markets like Ahmedabad, Chennai and Kolkata are expected to bring spill over demand for back office operations from companies.