The CEV Group launched the Registered Valuers Club YouTube platform to educate and empower valuation professionals in India through expert discussions, case studies, and practical insights on various valuation standards and regulatory updates. The channel provides comprehensive guidance on the eligibility criteria and registration process for becoming a registered valuer under Indian laws, including educational qualifications, experience requirements, and mandatory courses. The discussion covered specific requirements for different asset classes, foreign degree recognition, experience documentation, and the application submission process, emphasizing the importance of compliance with registration rules and proper documentation.

Valuation Professionals’ Knowledge Platform

CEV introduced the Registered Valuers Club, a YouTube platform powered by the Council of Engineers and the CEV Group, aimed at educating and empowering valuation professionals in India. The channel offers expert discussions, case studies, and practical insights on valuation standards, regulatory updates, and career growth, focusing on land, building, plant and machinery, and securities valuations. CEV invited viewers to subscribe, share knowledge, and engage with the community to strengthen India’s valuation ecosystem. The official website, http://www.cevnews.in, provides additional resources, and CEV encouraged viewers to reach out with any questions.

FREQUENTLY ASKED QUESTIONS

REGISTERED VALUERS

(FOR INDIVIDUAL VALUER APPLICANTS)

By:

Insolvency and Bankruptcy Board of India

7th Floor, Mayur Bhawan, Shankar Market,

Connaught Circus, New Delhi -110001

“Frequently Asked Questions: Registered Valuers (Individual Applicants)”

Hello and a warm welcome to all members of the valuation community — fellow valuers, aspiring professionals, students, and enthusiasts.

This is Registered Valuers Club, brought to you by the Council of Engineers & Valuers — CEV Group.

We are pleased to launch a very special video presentation today: “Frequently Asked Questions: Registered Valuers (For Individual Valuer Applicants)” — covering the key topics as outlined on the official website of IBBI.

In this video, we will walk you through all the essential queries that many of you have — clearly and comprehensively. Specifically, we will address:

-

General questions related to the registered valuer process — who qualifies, what to expect, and general rules.

-

Educational Qualification & Experience — What academic credentials and professional experience are required to become a registered valuer?

-

Educational Course — details about mandatory courses or training programs that applicants must complete.

-

Valuation Examination — information on the exam format, eligibility, syllabus, preparation tips, and exam procedure.

-

Application Filing — step-by-step guide on how to apply to IBBI as an individual valuer, required documents, timelines, and fees.

-

Point of Contact — where and how to get official information, whom to reach out to in case of queries or support.

Our goal with this video is to clarify doubts, remove confusion, and empower you with accurate, up-to-date information — so that your journey to becoming an IBBI-registered valuer is smooth, transparent, and well-informed.

If you are an aspiring valuer or planning to apply soon — this video is especially for you. For those already practising — it’s a handy reference to ensure compliance and stay updated.

So without further delay — let’s begin our FAQ walkthrough on “Registered Valuers: Individual Applicant Guidelines.”

Once again, welcome to Registered Valuers Club by CEV Group. Let’s get started.

FAQs on Registered Valuers Registration

The CEV Group presented a video explaining frequently asked questions about registered valuers for individual applicants, based on a document uploaded by the Insolvency and Bankruptcy Board of India (IBBI) on October 1, 2021. The presentation covered six key points, including general questions about valuers, eligibility requirements, educational qualifications and experience, mandatory courses, valuation examination details, and the application process. The video aimed to clarify doubts and provide up-to-date information to assist aspiring valuers in their registration process.

Registered Valuer Eligibility and Registration

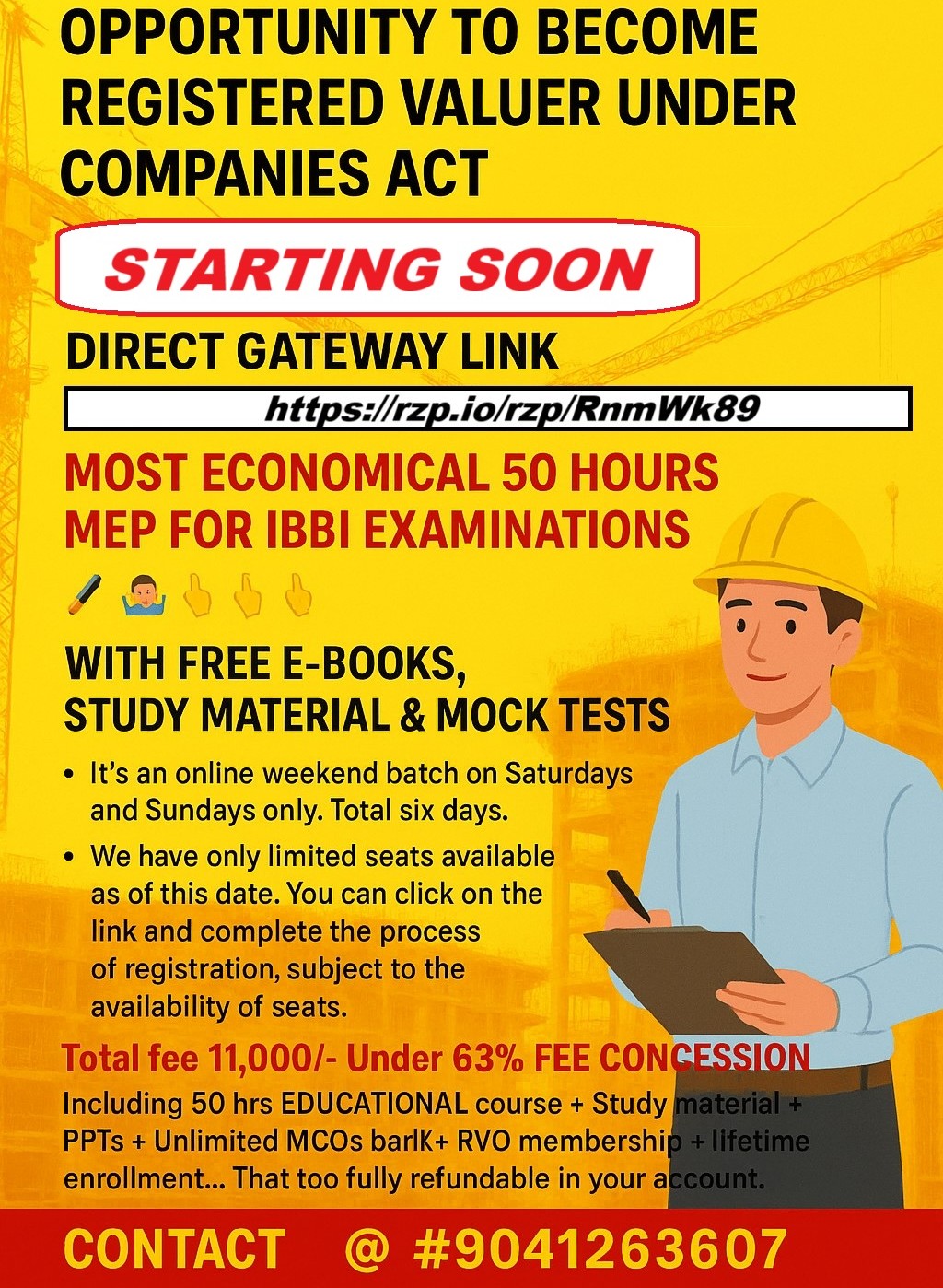

The discussion focused on the eligibility criteria and registration process for becoming a registered valuer under the Companies Act 2013 and Insolvency and Bankruptcy Code 2016. CEV explained the requirements, including being a member of a registered valuer organization (RVO), completing a 50-hour education course, passing a valuation examination, and meeting fitness and properness criteria. They clarified that while registered valuers can undertake valuations under specific acts, unregistered valuers can continue under other laws. The process involves enrolling with an RVO, undertaking education, passing exams, submitting applications, and paying fees. Conditions for registration include maintaining compliance with rules, not conducting valuations outside registered asset classes, and addressing grievances.

Valuer Registration Eligibility Criteria

The discussion focused on eligibility criteria for registration as a valuer in India, including educational qualifications and experience requirements. It was clarified that applicants must have a specified postgraduate degree or equivalent professional qualification, along with relevant experience, to be eligible for registration. The conversation also addressed the importance of providing a final degree certificate rather than a provisional one, and the need to confirm specialization through official documentation from the educational institution. It was noted that self-declaration is not accepted for establishing specialization, and there is no specific list of recognized Indian universities.

Eligibility Criteria for Registered Valuers

The discussion focused on eligibility criteria for registration as a registered valuer for different asset classes. It was clarified that an MBA degree recognized in 2007 does not make an applicant eligible for registration if the degree was not recognized at the time the course was undertaken. For asset class land and building, a commerce graduate with a postgraduate degree in real estate valuation and over five years of experience in valuation for the said asset class is eligible for registration. However, if the postgraduate degree in real estate valuation was completed after the five years of experience, the applicant would not be eligible.

Valuer Registration Eligibility Criteria

The discussion focused on eligibility criteria for registration as a registered valuer for different asset classes. CEV explained that for plant and machinery valuations, a BE mechanical applicant requires postgraduate education and relevant experience after obtaining the degree. For land and building valuations, a BArch applicant is eligible if they have the required experience after completing their qualification. CEV clarified that a chartered accountant with experience in financial securities is eligible for registration as a valuer for securities or financial assets, regardless of their graduation status. The discussion also covered that only applicants with an MBA in finance, including those from foreign universities, are eligible for registration as valuers for securities or financial assets.

Foreign Degree and Experience Documentation

The discussion focused on the requirements for foreign degree recognition and experience documentation for valuation registration. The Ministry of Human Resources and Development (MHRD) recognizes foreign qualifications equated by the Association of Indian Universities (AIU), requiring applicants to submit an AIU equivalence certificate. For experience verification, documentary proof including service certificates, client confirmations, and ITRs are required, with specific requirements for different types of employment and professional services. The 50-hour mandatory education course, conducted by RVOs, is mandatory for all applicants regardless of age, and passing the online valuation examination within 36 months of the course completion is required for registration.

IBBI Valuer Registration Process Overview

The discussion covered the registration process for registered valuers, including application submission, fee payment, and timelines. It was clarified that applications must be submitted online, with a non-refundable fee of Rs. 5,000 plus GST, and any discrepancies or queries must be addressed within 21 days to avoid rejection. The process involves creating a user account on the IBBI portal, submitting personal and professional details, and uploading supporting documents. After review, if the application complies with the eligibility conditions, it is recommended for registration, and the applicant is intimated of the approval, with a registration number granted and details published on the IBBI website.

BEST RVO TO JOIN TO BECOME A REGISTERED VALUER UNDER COMPANIES ACT-2013

To register with the Ministry of Corporate Affairs (MCA) as a valuer, individuals need to meet specific eligibility criteria, primarily focused on experience rather than age-based exemptions from exams. While age is a factor, it’s not a barrier to registration if other requirements are met.