EXEMPTION FROM RATEABILITY

The term “exemption from rateability” typically refers to a situation where a property owner is not required to pay rates or property taxes on their property. This may occur for a variety of reasons, including:

- Government exemption: Some properties may be exempt from rates or property taxes by law, such as government-owned properties, places of worship, or charitable organizations.

- Personal exemption: In some cases, individual property owners may be granted exemptions from rates or property taxes based on their personal circumstances, such as pensioners or disabled persons.

- Property usage exemption: Certain types of properties may be exempt from rates or property taxes if they are used for specific purposes, such as agricultural land, public parks, or educational institutions.

It’s important to note that the specific rules and regulations governing exemptions from rateability can vary depending on the location and jurisdiction in which the property is located. Therefore, it’s advisable to consult with local tax authorities or a qualified legal professional to determine if a property is eligible for exemption from rateability.

The types of properties that are typically granted exemptions from rateability vary depending on the country and local regulations. However, some common types of properties that may be eligible for exemption from rateability include:

- Government-owned properties: Properties owned by the government, such as public parks, libraries, and schools, are often exempt from property taxes.

- Places of worship: Churches, mosques, temples, and other places of worship may be exempt from property taxes in recognition of their religious and cultural significance.

- Charitable organizations: Non-profit organizations that provide charitable services, such as hospitals, schools, and community centers, may be eligible for tax exemptions.

- Agricultural land: In some countries, agricultural land may be exempt from property taxes to encourage farming and food production.

- Educational institutions: Colleges, universities, and other educational institutions may be eligible for exemptions from property taxes.

- Historical buildings: Some historic buildings and properties may be granted tax exemptions in recognition of their cultural and historical significance.

It’s important to note that the specific rules and regulations governing exemptions from rateability can vary depending on the location and jurisdiction in which the property is located. Therefore, it’s advisable to consult with local tax authorities or a qualified legal professional to determine if a property is eligible for exemption from rateability.

FOR MANY MORE UPDATES AVAILABLE CLICK BELOW

CLICK THE BELOW LINK TO READ THE COMPLETE CONTENTS

SOME CONTENTS OF THIS WEBSITE ARE FOR GOLD SUBSCRIBERS ONLY.

Join us as a GOLD SUBSCRIBER and get access to read important books.

KIND ATTENTION

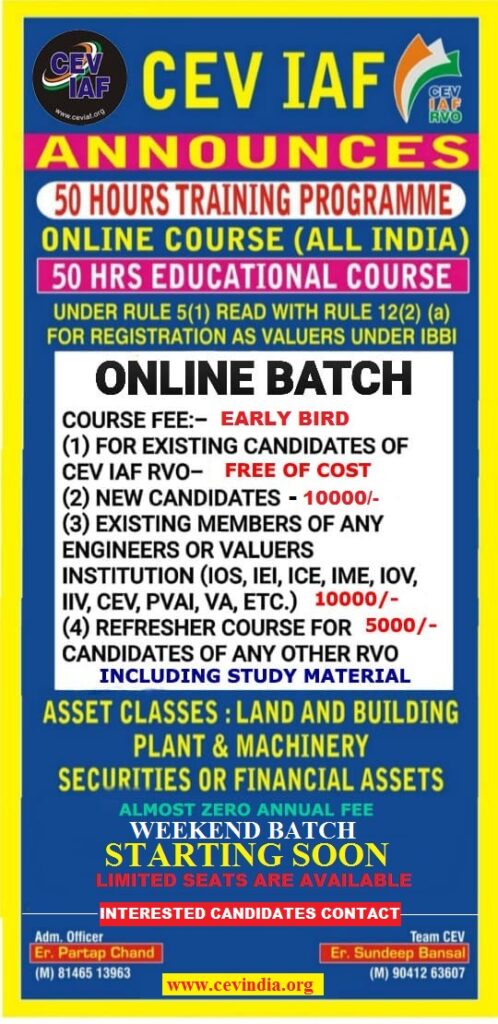

We are going to close all what’s groups of CEV soon due to difficulties in posting information or message in more than 5 groups of CEV at a time.

All future posts of empanelment notices & professional importance will be shared on

1. https://t.me/+dbHNkNO22xsyYTY1

2. www.valuerworld.com

3. The Twitter handle of CEV India

https://twitter.com/cevindia?t=XbqlvnwUVz1G3uPgs749ww&s=09

after closing the groups.

All members of these groups are requested to register themselves at the following link immediately for Getting all related timely updates.