CASE STUDY

The Central Bureau of Investigation (CBI) has registered an FIR against ABG Shipyard Ltd and its directors, including chairman and managing director Rishi Kamlesh Agarwal, in what could be the biggest bank fraud case in the history of India.

One of the most prominent private sector shipping firms, the firm was booked for allegedly defrauding a consortium of 28 banks to the tune of Rs. 22,842 crore.

The Central Bureau of Investigation (CBI) has filed a case against ABG Shipyard Ltd for allegedly cheating a consortium of 28 banks and financial institutions.

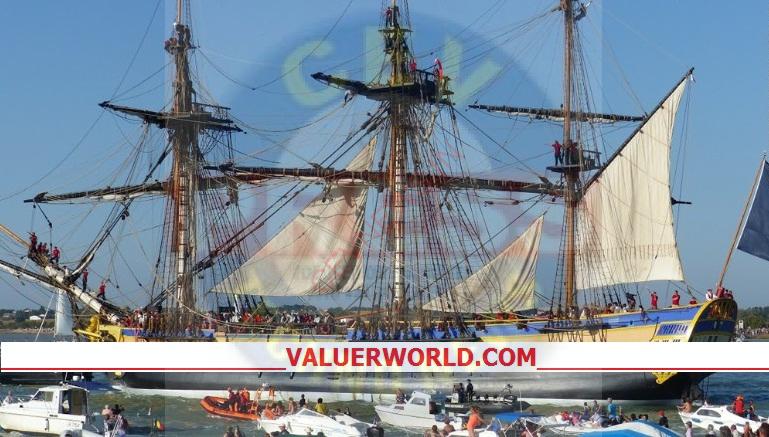

“ABG Shipyard Ltd is the flagship company of the ABG Group which is engaged in shipbuilding and ship repair. The shipyards are located in Dahej and Surat in Gujarat. ABG Shipyard, one of the most prominent private sector shipping firms, was on Saturday booked for allegedly defrauding 28 banks to the tune of Rs.22,842 crore. Apart from Agarwal, Santhanam Muthuswamy, Ashwini Kumar, Sushil Kumar Agarwal and Ravi Vimal Nevetia have also been named in the case. The group is promoted by Rishi Agarwal, a major player in the Indian ship building industry.”

According to a complaint by the State Bank of India, the company owes Rs.2,925 crore to the bank, Rs.7,089 crore to ICICI Bank, Rs.3,634 crore to IDBI Bank, Rs.1,614 crore to Bank of Baroda, Rs.1,244 to PNB and Rs.1,228 crore to IOB. Funds were used for purposes other than for which they were released by banks, the CBI said.

The CBI had on Saturday released a statement saying searches were conducted at 13 locations in the premises of accused including private company, directors at Surat, Bharuch, Mumbai, Pune etc which led to recovery of incriminating documents.

The company is learnt to have constructed over 165 vessels, 46 for overseas customers, in the past 16 years, including specialized vessels like the newsprint carriers. It has the capacity to build vessels up to 18,000 dead weight tonnage (DWT) at the Surat shipyard and up to 1,20,000 dwt at its Dahej facility.

History of Case: The case came to light following a complaint by the State Bank of India. The bank had first filed a complaint on November 8, 2019, on which the CBI had sought some clarifications on March 12, 2020. A fresh complaint was filed again in August that year. After “scrutinising” for over one and a half years, the CBI acted on the complaint filing an FIR on February 7.The SBI consortium of 28 banks and financial institutions have allegedly been cheated of a massive total of Rs.22,842 crore.

This is the biggest bank fraud case registered by the Central Bureau of Investigation, even bigger than the Punjab National Bank scam that involved fugitive diamantaire Nirav Modi and his uncle Mehul Choksi. Meanwhile, the Forensic Audit by consultancy Ernst and Young (EY) revealed that between 2012 and 2017, the accused colluded together and committed illegal activities including diversion of funds, misappropriation and criminal breach of trust.