INCOME TAX DEPARTMENT ISSUES NOTICES TO REGISTERED VALUERS IN TELANGANA FOR MANDATORY PERFORMANCE REVIEW

Er. P. V. Rajesh (Bureau Chief)

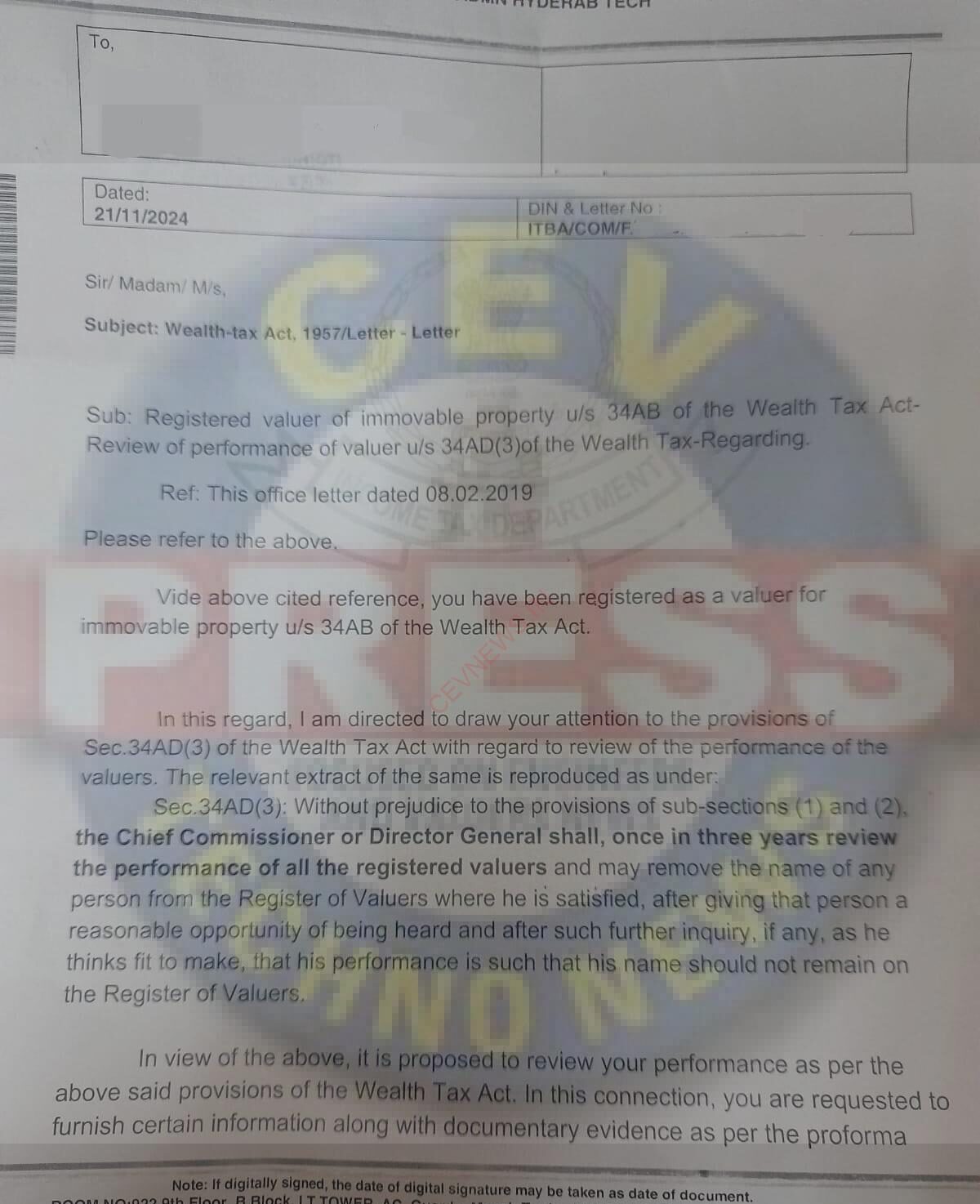

Hyderabad (Techno Journalist) 10/12/2024 – In a significant move aimed at ensuring accountability and professionalism among registered valuers, the Income Tax Department has served notices to registered valuers of immovable properties in Telangana under Section 34AB of the Wealth Tax Act, 1957. These notices, which mark the initiation of a mandatory performance review as stipulated under Section 34AD(3) of the same Act, are part of a nationwide drive to ensure that valuers uphold high standards of transparency and integrity in their practices.

Mandatory Periodic Review for Valuers

The notices highlight the requirement for periodic evaluations, which must be conducted every three years. This process is designed to assess the performance and qualifications of valuers registered with the Income Tax Department and ensure they continue to meet the rigorous standards established under the Wealth Tax Act.

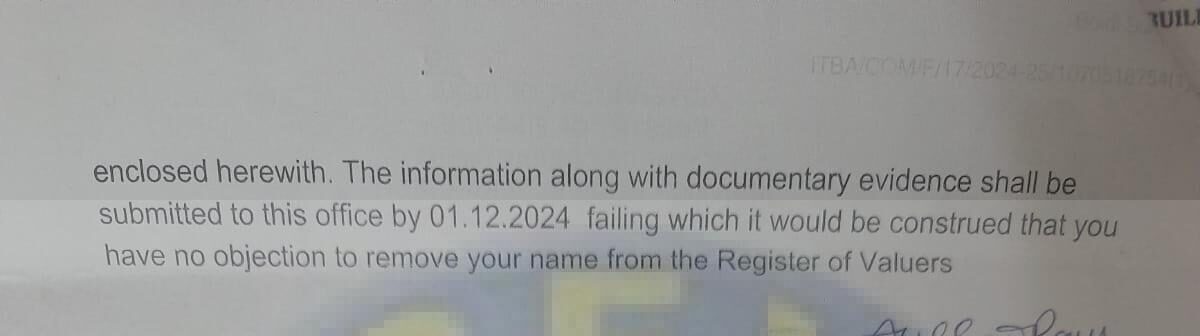

The Income Tax Department has specifically requested that valuers submit detailed information and supporting documents within the timeline specified in the notices. These documents will be scrutinized to assess their adherence to legal and professional standards. Failure to comply with the submission requirements will have serious consequences, including the presumption of no objection to the removal of the valuer’s name from the official Register of Valuers.

Consequences for Non-Compliance

The review process is not merely procedural but carries substantial implications for those who fail to meet the standards. Valuers who do not comply with the notice or whose performance is deemed unsatisfactory will be at risk of being delisted from the Register of Valuers, effectively barring them from practicing as registered valuers. This action highlights the Income Tax Department’s commitment to maintaining the credibility and professionalism of valuers involved in property valuation.

According to legal experts, this move underscores the government’s growing emphasis on transparency and accountability in the valuation industry, particularly in the wake of increasing scrutiny over property dealings and valuations. The review process is seen as an effort to streamline the industry and eliminate substandard practices that could undermine public trust in property valuations.

The Importance of Compliance

Registered valuers are urged to take immediate action to comply with the notices, as failing to do so could result in professional setbacks and loss of reputation. The notices have created a sense of urgency among the valuer community, with many calling for prompt clarification on the documents required and the procedures to be followed.

The Income Tax Department has emphasized that the goal of the exercise is not punitive but to enhance the overall quality of valuation services. Valuers who submit the required documentation and demonstrate their adherence to the established guidelines will have their names retained on the register, securing their professional credentials and reputation.

Government’s Focus on Transparency

This move is in line with the government’s broader focus on strengthening the regulatory framework for professionals in various sectors. By ensuring that valuers are held accountable for their performance, the authorities aim to foster a more transparent, reliable, and trustworthy property valuation system across the country.

The department has also noted that this performance review process is mandatory and periodic, which means valuers will be required to undergo such evaluations at regular intervals to maintain their registration. It is expected that the review process will be expanded to other states in the coming months as part of the ongoing regulatory reforms.

Call to Action for Valuers

Registered valuers in Telangana are strongly encouraged to take immediate steps to comply with the Income Tax Department’s notice. Submitting the necessary documents on time will not only ensure that they retain their registration but will also affirm their commitment to maintaining high standards in the field of property valuation.

As the government continues to implement these oversight measures, valuers are urged to view this process as an opportunity to demonstrate their competence and professionalism. It is also a reminder that upholding the integrity of the valuation profession is essential for sustaining public trust in the property and real estate sectors.

For more details on the required documentation and submission process, valuers are advised to refer to the official notices sent by the Income Tax Department or contact the relevant authorities for clarification.

This move by the Income Tax Department has raised significant awareness about the need for regular scrutiny and accountability in the property valuation sector, marking a step toward a more regulated and transparent industry in India.