IBBI CELEBRATED ITS EIGHTH ANNUAL DAY ON 1ST OCTOBER 2024

Insolvency and Bankruptcy Board of India

No. IBBI/PR/2024/22 Dated-01/10/2024

INSOLVENCY AND BANKRUPTCY BOARD OF INDIA CELEBRATES ITS EIGHTH ANNUAL DAY

CEV IAF RV MEMBERS DELEGATION ATTENDED THIS MEGA-EVENT

The Insolvency and Bankruptcy Board of India (IBBI) celebrated its Eighth Annual Day today. Chief Justice (Retd.) Shri Ramalingam Sudhakar, Hon’ble President, National Company Law Tribunal graced the occasion as the Chief Guest.

In order to commemorate the establishment of the IBBI, it has instituted an Annual Day Lecture Series. Mr. Amitabh Kant, India’s G20 Sherpa and Former CEO of NITI Aayog delivered the Annual Day Lecture this year.

Chief Justice (Retd.) Shri Ramalingam Sudhakar, Hon’ble President, National Company Law Tribunal in his keynote address highlighted the transformative impact of the Insolvency and Bankruptcy Code (IBC / Code) on India’s corporate insolvency landscape. Quoting the Hon’ble Finance Minister’s budget speech, he emphasized the need to further strengthen the IBC ecosystem and announced plans for an integrated technology platform to enhance consistency, transparency, and timely outcomes.

He also referenced the President of India’s address to Parliament, where she recognized the IBC as a landmark reform of the past decade that has strengthened India’s banking sector, making public sector banks robust and profitable. He commended IBBI for being a proactive regulator that engages with stakeholders and fosters research in insolvency law to support informed policy decisions. He praised its meticulous regulatory approach aligned with the nation’s economic objectives and emphasized the need for continuous innovation, capacity building, and the use of technology to ensure timely admissions and resolutions.

Delivering the Annual Day lecture, Sh. Amitabh Kant applauded IBBI for the noteworthy achievements of the IBC in the short span of 8 years. He noted that India’s global ranking in World Bank’s Ease of Doing Business Index improved significantly, jumping 79 positions from 142 in 2014 to 63 in 2016, thanks to the transformative framework established by the IBC. In his remarks, Mr. Kant referenced Hon’ble Justice Rohinton Fali Nariman’s assertion that “the defaulter’s paradise is lost. In its place, the economy’s rightful position has been regained.” He characterized the IBC as a “lighthouse of a new era,” emphasizing its role in promoting credit discipline and contributing to a historic reduction in non-performing assets (NPAs). Citing the Reserve Bank of India’s report from June 2024, he

highlighted that the Gross Non-Performing Assets have reached a 12-year low of 2.8%, with Net NonPerforming Assets at 0.6%. These statistics underscore the positive impact of the IBC on the Indian economy.

Dr. V. Anantha Nageswaran, Chief Economic Advisor, Ministry of Finance while delivering the special address expressed his gratification regarding the increased pace of resolutions under the Insolvency and Bankruptcy Code (IBC). He articulated Joseph Schumpeter’s theory of creative destruction, which posits that innovation and technological advancements can dismantle existing economic structures—such as jobs, firms, and industries—to pave the way for new ones. Dr. Nageswaran characterized the IBC as a creative force driving economic growth and national progress.

He referred to a study conducted by the Indian Institute of Management Ahmedabad (IIMA), which assessed the effectiveness of the resolution process by analysing the performance of firms before and after resolution. The findings indicated a substantial increase in market capitalization for companies resolved under the IBC, rising from ₹2 lakh crore to ₹6 lakh crore. Additionally, average sales for these firms increased by 76% within three years of resolution, while average employee expenses rose by 50% during the same period, reflecting enhanced employment intensity among the resolved firms. The study also noted a significant 50% increase in the average total assets of these firms’ post-resolution, alongside a remarkable 130% increase in capital expenditure (CAPEX).

Addressing the occasion, Sh. Ravi Mital, Chairperson, IBBI reflected on the significant achievements during the eight-year journey of the IBC. He noted that approximately 1,000 resolutions have been passed by the Hon’ble National Company Law Tribunal (NCLT) in this period, with 450 of those occurring in the last two years alone. This statistic indicates that 45% of all resolutions have taken place within the past two years.

In the last fiscal year alone, 271 cases were successfully resolved. Shri Mital expressed his gratitude to all stakeholders for their contributions to the impressive progress of the Code over these years. He further noted that the resolutions through IBC, facilitate recovery to the banking system, reshaping the NPA narrative and compelling borrowers to prioritize loan repayments paving the way for Government of India’s aim of Viksit Bharat.

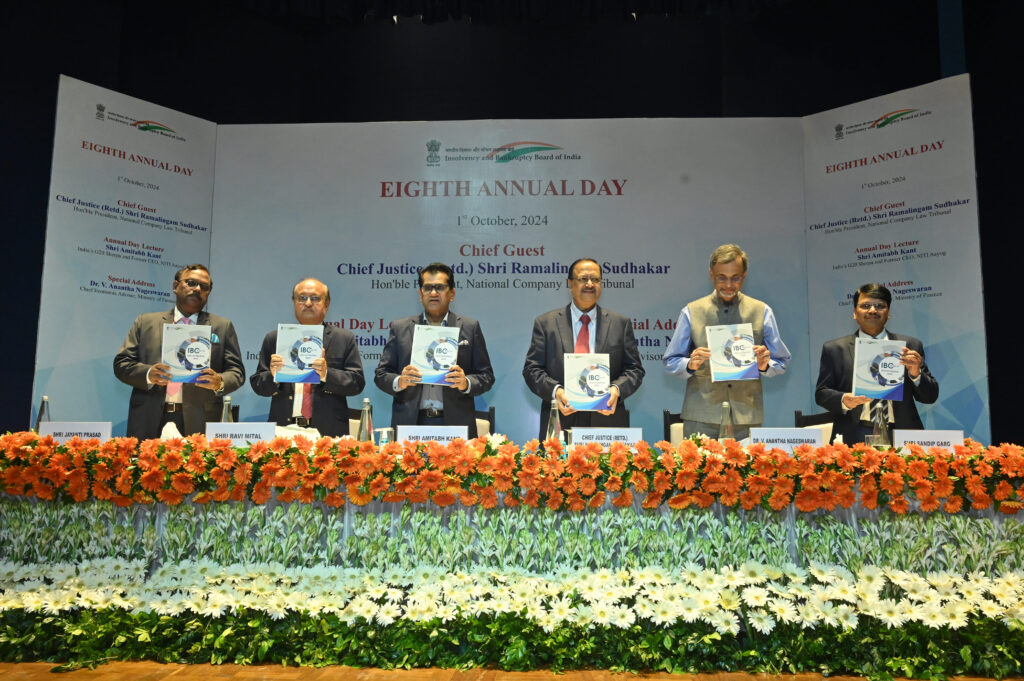

As part of the Annual Day celebrations, Chief Justice (Retd.) Shri Ramalingam Sudhakar, Hon’ble President, National Company Law Tribunal; Sh. Amitabh Kant, India’s G20 Sherpa and Former CEO of NITI Aayog; Dr. V. Anantha Nageswaran, Chief Economic Advisor, Ministry of Finance; Sh. Ravi Mital, Chairperson, IBBI; Sh. Jayanti Prasad, Whole Time Member, IBBI and Sh. Sandip Garg, Whole Time Member, IBBI released IBBIs annual publication, “IBC के आठ वर्ष: शोध एवं विशलेषण”. This publication marks the sixth consecutive annual release of the IBBI’s Annual Publication, coinciding with the completion of eight years since the Code’s inception. It explores the evolving insolvency regime, assesses key stakeholders’ roles, and analyzes the intersection of taxation and insolvency. The publication addresses the treatment of workmen’s dues, international legal obligations, and privacy concerns in data protection. It also examines challenges faced by homebuyers and the potential for direct dissolution during CIRP. Highlighting digital transformation, it discusses AI and blockchain’s role in streamlining insolvency processes and emphasizes the need for a robust valuation framework. Additionally, it includes nine research papers presented at the IIM Ahmedabad Annual Research Workshop on Insolvency and Bankruptcy in March 2024.

The 8th Annual Day of IBBI was a momentous occasion, reflecting on the achievements and contributions made in the field of insolvency and bankruptcy over the years. The event brought together large number of esteemed dignitaries and stakeholders of the insolvency regime, namely, officers of the Government and regulatory bodies, insolvency professional agencies and registered valuer’s organisations, insolvency professionals, registered values, other professionals, debtors, creditors, business leaders and academicians. The event was also live telecast online. Shri Sandip Garg, Whole Time Member, IBBI proposed a hearty vote of thanks at the conclusion of the event.

The event witnessed the active participation of several Registered Valuers of the CEV Integral Appraisers Foundation (Registered Valuers Organisation).

The festivities were marked by the enthusiastic participation of numerous registered valuers associated with the CEV Integral Appraisers Foundation (Registered Valuers Organisation). The event provided a platform for these valuers to showcase their dedication and commitment to the field, fostering a sense of camaraderie among professionals in the valuation domain.

The registered valuers from CEV Integral Appraisers Foundation exhibited immense enthusiasm and dedication in their participation. The annual day celebration provided a platform for these valuers to showcase their expertise and commitment to the field of valuation. It was an opportunity to recognize their pivotal role in facilitating the insolvency and bankruptcy processes in India by providing accurate and impartial valuations.

It also served as a platform to acknowledge and appreciate their contributions to the insolvency and bankruptcy framework. The vibrant participation reflected not only the collective spirit of the valuation community but also their keen interest in contributing to the overarching goals of IBBI. Such gatherings serve as crucial opportunities for knowledge exchange, networking, and strengthening the collaborative fabric of the valuation industry.