HOW TO BECOME A VALUER IN INDIA

COMPLETE E-BOOK

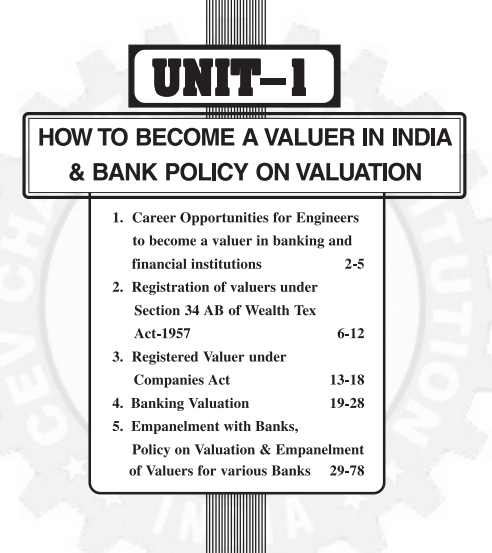

CHAPTER-1

CAREER OPPORTUNITIES FOR ENGINEERS TO BECOME A VALUER IN BANKING AND FINANCIAL INSTITUTIONS

HOW ENGINEERS CAN BUILD THEIR CAREERS AS A VALUATION PROFESSIONAL

A property valuer is a professional who makes a detailed report on an individual/business/ or commercial property. The property valuation report is made based on the results of the detailed inspection, reviewing, studying the location, and more. If anyone are looking for ‘property valuers nearby’ then Valuers Club eases his task and provides you with a list of these values on www.valuersclub.com.

Service seekers will also get their address and contact details, services offered, hours of operation, years of experience in the field, and other details here. Browse through the user reviews that these valuers have received and make a thoughtful decision.

Roles of property valuers

Valuing a property is essential to knowing about its appreciation or depreciation. Property valuers are professionals who study, analyze, and make a report on the total estimation of an individual’s property. These services can be availed for both, commercial property as well as an individual’s private …….. READ MORE

CHAPTER-2

REGISTRATION OF VALUERS UNDER SECTION 34 AB OF WEALTH TAX ACT-1957

ALL YOU NEED TO KNOW ABOUT

Section 34AA of the Act provides that notwithstanding anything contained in this Act, any assessee who is entitled to or required to attend before any wealth-tax authority or the Appellate Tribunal in connection with any matter relating to the valuation of any asset, except where he is required under this Act to attend in person, may attend by a registered valuer.

Qualifications for Registered valuer

Rule 8A of the Wealth Tax Rules, 1957 provides the qualifications of the Registered Valuer. The said Rule prescribes the qualifications for registration of valuers of different classes of asset………..READ MORE

CHAPTER-3

Registered Valuer under Companies Act

Step-I

How to become a Registered Valuer under Companies Act?

The Companies (Registered Valuers and Valuation) Rules, 2017, as amended, require that only a person registered with the IBBI as a registered valuer can conduct valuations required under the Companies Act, 2013 and the Insolvency and Bankruptcy Code, 2016 with effect from 1st February, 2019.

A person, who is rendering valuation services under the Companies Act, 2013, may continue to do so without a certificate of registration up to 31st January, 2019…….READ MORE

CHAPTER-4

BANKING VALUATION

VALUATION FOR BANKING

Banking activity means Lending, which by its nature is attached with diverse risks which can be broadly categorized as financial risk, industrial risk and management risk. The lending branches have, apart from assessing the credit requirements of the borrower, the economic and technical viability of the activity, has to exercise a high degree of caution in examining, verifying and investigating the title of the mortgagor. This critical activities have to be entrusted to professionals outside the domain of Bank’s albeit to the panel Advocate and panel Valuer……….. READ MORE

CHAPTER-5

EMPANELMENT WITH BANKS

POLICY ON VALUATION & EMPANELMENT OF VALUERS FOR VARIOUS BANKS

POLICY GUIDELINES

(Part-I)

Purpose of Valuation and Appointment of Valuers

Valuers are engaged for:

the purpose of ascertaining the value of the property / assets offered as security

the purpose of periodically ascertaining the value of the property that has been mortgaged, whether it is increasing or decreasing over the mortgage period

for the purpose of realizing the value of non-performing assets (NPAs) and

the purpose of resumption of properties in cases of default.

Empanelment of valuers

Following are the guidelines and process for empanelment of valuers………..READ MORE

CLICK THE BELOW LINK TO READ THE COMPLETE CONTENTS