THE ROLE OF LOCATION IN LAND AND BUILDING ASSET CLASS

Introduction: Location plays a pivotal role in the valuation and performance of the land and building asset class. Whether it’s for residential, commercial, or industrial purposes, the location of a property can significantly impact its desirability, market value, and potential returns on investment. This article explores the multifaceted role of location in the land and building asset class, highlighting its importance and the various factors that influence property value.

- Accessibility and Convenience: One of the primary factors that determine the value of a property is its accessibility and proximity to key amenities and services. Properties located in close proximity to transportation hubs, schools, hospitals, shopping centers, and recreational facilities tend to be more attractive to potential buyers or tenants. The convenience factor associated with a well-located property can enhance its marketability and rental or resale value.

- Neighborhood and Surroundings: The neighborhood and surroundings of a property significantly impact its value. Factors such as the quality of schools, safety, cleanliness, and overall aesthetic appeal can contribute to the desirability of a location. Properties situated in well-maintained neighborhoods with a sense of community and low crime rates are generally more sought after, leading to higher property values.

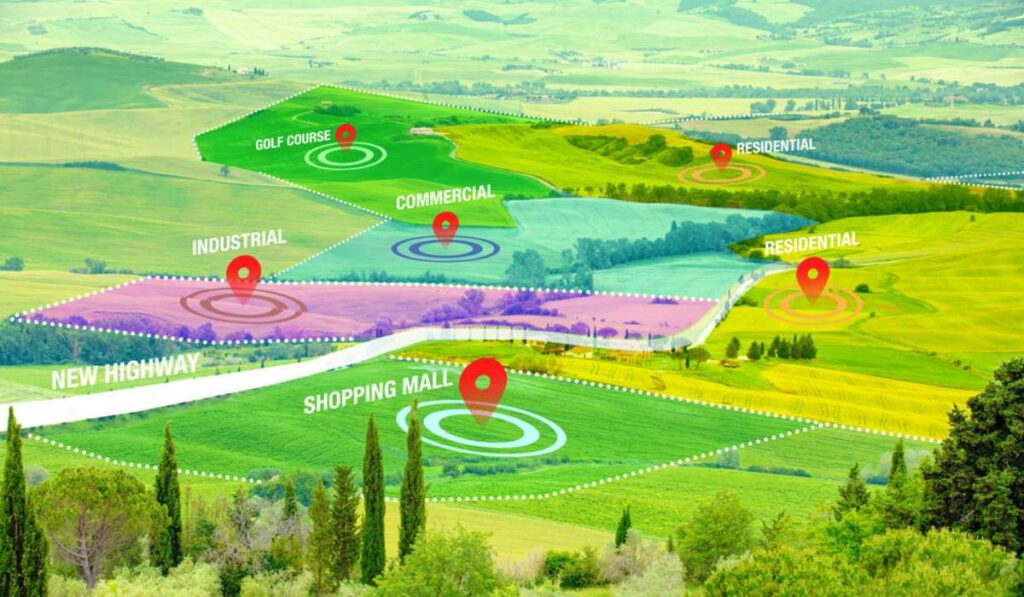

- Economic Growth and Development: The economic prospects of a location have a direct impact on the land and building asset class. Areas experiencing robust economic growth, infrastructure development, and employment opportunities tend to attract investors and drive up property values. Regions with thriving industries, emerging markets, and favorable business environments often witness increased demand for real estate, resulting in capital appreciation and potential rental income growth.

- Supply and Demand Dynamics: The concept of supply and demand is fundamental in the real estate market. The availability of land and buildings in a particular location and the demand for properties in that area can greatly influence their prices. Limited supply coupled with high demand creates a competitive market, leading to increased property values. Conversely, an oversupply of properties in a specific location may exert downward pressure on prices.

- Future Growth Potential: The assessment of a location’s future growth potential is crucial for investors in the land and building asset class. Factors such as urbanization plans, infrastructure projects, and government initiatives for economic development can have a significant impact on property values. Areas earmarked for future commercial or residential development, improved transportation networks, or upcoming tourist attractions tend to attract real estate investors seeking long-term appreciation.

- Environmental Factors: The environmental characteristics of a location also play a role in determining the value of land and buildings. Properties situated in areas with natural beauty, scenic views, or close proximity to parks, lakes, or mountains often command premium prices. On the other hand, locations prone to natural disasters, environmental pollution, or high noise levels may experience lower property values due to potential risks and decreased desirability.

- Regulatory and Legal Considerations: Regulatory and legal factors related to a location can impact property values. Zoning regulations, building codes, land-use restrictions, and property tax policies can vary from one jurisdiction to another, affecting the development potential and overall attractiveness of a location. Understanding the legal framework and complying with the applicable regulations is essential for investors in the land and building asset class.

Conclusion: The role of location in the land and building asset class cannot be overstated. It influences the desirability, value, and investment potential of properties. Accessibility, neighborhood quality, economic growth, supply and demand dynamics, future growth potential, environmental factors, and regulatory considerations all shape the attractiveness and financial performance of a location. Investors and stakeholders in real estate must carefully evaluate these factors to make informed decisions and maximize their returns on land and building investments.