DEFINING PLANT, MACHINERY, FURNITURE, FIXTURES, AND FITTINGS: JUDICIAL INTERPRETATIONS AND IMPLICATIONS IN VALUATION

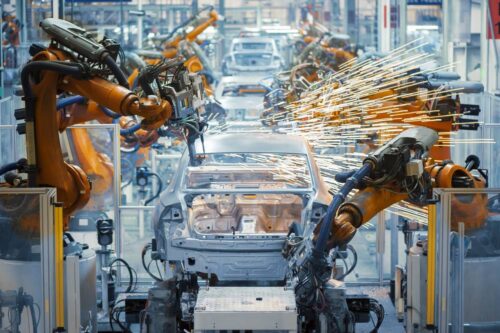

Introduction: In the field of valuation, determining the scope and definition of assets such as plant, machinery, furniture, fixtures, and fittings is crucial. These assets play a significant role in various industries and can have a significant impact on the overall value of a business or property. However, the interpretation and classification of these assets have often been subject to legal disputes and challenges, leading to the need for judicial interventions. This article explores the judicial interpretations of plant, machinery, furniture, fixtures, and fittings and their implications in the context of valuation.

- Historical Perspectives: To understand the current judicial interpretations, it is essential to examine the historical perspectives that have shaped the definition of these assets. The legal frameworks and precedents set in various jurisdictions have laid the foundation for the assessment of plant, machinery, furniture, fixtures, and fittings. This section provides an overview of significant historical cases and their impact on valuation practices.

- Judicial Interpretations: a. Plant and Machinery: Courts have often grappled with distinguishing between plant and machinery, especially when technological advancements blur the lines. This section explores landmark cases where courts have examined the characteristics and functions of equipment to determine their classification as plant or machinery. The judicial interpretation of these terms and their relevance to valuation exercises are discussed.

- Furniture, Fixtures, and Fittings: The distinction between furniture, fixtures, and fittings can be equally challenging. Courts have addressed the issue of whether an asset is considered a fixture or part of the building structure. By analyzing notable legal cases, this section sheds light on the factors influencing the classification of assets and their implications for valuation.

- Implications in Valuation: The judicial interpretations of plant, machinery, furniture, fixtures, and fittings have significant implications for valuation exercises. Valuers and professionals in the field must understand the legal framework and judicial precedents to accurately assess the value of these assets. This section examines the practical implications of judicial interpretations, including the impact on financial reporting, tax assessments, and asset valuation methodologies.

- International Variances: Valuation practices and judicial interpretations of these assets may vary across different jurisdictions. This section provides a comparative analysis of the approaches taken in different countries, highlighting the similarities and differences in defining plant, machinery, furniture, fixtures, and fittings. Understanding these international variances is crucial for global valuation practices and cross-border transactions.

- Emerging Trends and Future Considerations: As technology continues to advance and industries evolve, new types of assets may pose challenges in terms of classification and valuation. This section explores emerging trends in asset definitions, such as digital assets and specialized equipment, and their potential implications for future judicial interpretations and valuation practices.

Conclusion: Judicial interpretations of plant, machinery, furniture, fixtures, and fittings have a profound impact on valuation exercises. The historical perspectives, case laws, and international variances shape the definition and classification of these assets. Valuers and professionals in the field must remain updated with the evolving legal landscape to accurately assess the value of businesses and properties. By understanding the implications of judicial interpretations, practitioners can navigate the complexities of asset valuation more effectively in the present and future.

Top of Form

Bottom of Form