RIGHTS OF MORTGAGEE AND MORTGAGOR

A mortgagor is the borrower who gives a mortgage over their property as security for a loan. The rights of a mortgagor can vary depending on the jurisdiction and the terms of the mortgage agreement. However, here are some common rights of a mortgagor:

1. Right to redeem: The mortgagor has the right to redeem the property by paying off the mortgage loan in full, including any interest and fees, at any time before the foreclosure sale.

2. Right to notice: The mortgagor has the right to receive notice of any legal action taken by the mortgagee, such as foreclosure proceedings or any other legal action.

3. Right to possession: The mortgagor has the right to remain in possession of the property until the foreclosure sale or until the mortgage is paid off in full.

4. Right to challenge foreclosure: The mortgagor has the right to challenge the foreclosure if they believe that the mortgagee has not followed the proper legal procedures or if there are other grounds for challenging the foreclosure.

5. Right to quiet enjoyment: The mortgagor has the right to quiet enjoyment of the property, meaning that the mortgagee cannot interfere with the mortgagor’s use and enjoyment of the property, unless the mortgage agreement specifically allows for it.

It is important to note that the specific rights of a mortgagor may vary depending on the jurisdiction and the terms of the mortgage agreement.

A mortgagee is the lender who holds the mortgage over a property as security for a loan. The rights of a mortgagee can vary depending on the jurisdiction and the terms of the mortgage agreement. However, here are some common rights of a mortgagee:

1. Right to payment: The mortgagee has the right to receive payment of the loan according to the terms of the mortgage agreement, including any interest and fees.

2. Right to possession: The mortgagee has the right to take possession of the property if the mortgagor defaults on the loan, subject to any legal procedures required in the jurisdiction.

3. Right to foreclosure: If the mortgagor defaults on the loan, the mortgagee has the right to foreclose on the property and sell it to recover the amount owing on the loan.

4. Right to insurance proceeds: If the mortgagor has insurance on the property and it is damaged or destroyed, the mortgagee may have the right to receive the insurance proceeds to apply towards the outstanding loan.

5. Right to acceleration: The mortgagee may have the right to accelerate the loan, meaning that the entire amount owing becomes due immediately, if the mortgagor breaches any of the terms of the mortgage agreement.

It is important to note that the specific rights of a mortgagee may vary depending on the jurisdiction and the terms of the mortgage agreement.

FOR MANY MORE UPDATES AVAILABLE CLICK BELOW

CLICK THE BELOW LINK TO READ THE COMPLETE CONTENTS

SOME CONTENTS OF THIS WEBSITE ARE FOR GOLD SUBSCRIBERS ONLY.

Join us as a GOLD SUBSCRIBER and get access to read important books.

KIND ATTENTION

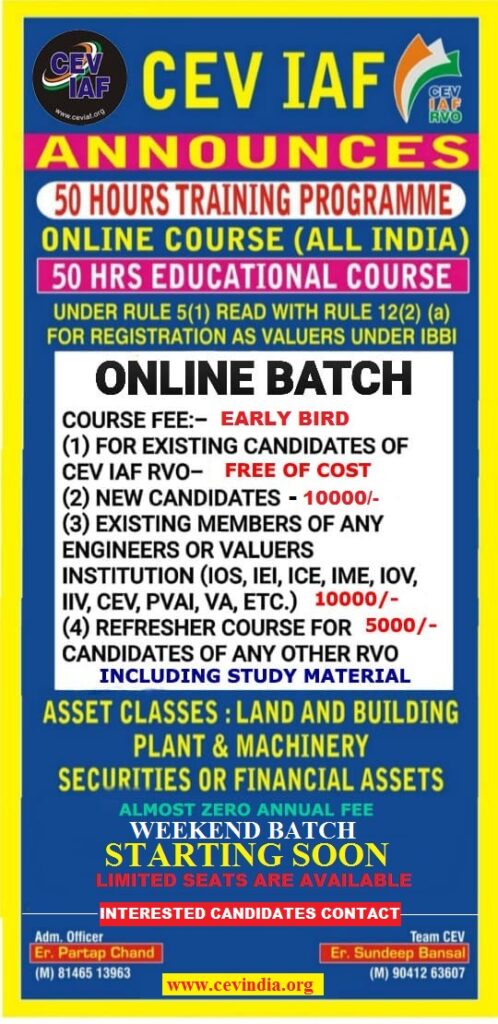

We are going to close all what’s groups of CEV soon due to difficulties in posting information or message in more than 5 groups of CEV at a time.

All future posts of empanelment notices & professional importance will be shared on

1. https://t.me/+dbHNkNO22xsyYTY1

2. www.valuerworld.com

3. The Twitter handle of CEV India

https://twitter.com/cevindia?t=XbqlvnwUVz1G3uPgs749ww&s=09

after closing the groups.

All members of these groups are requested to register themselves at the following link immediately for Getting all related timely updates.