COVERAGE UNDER PLANT & MACHINERY INSURANCE POLICY

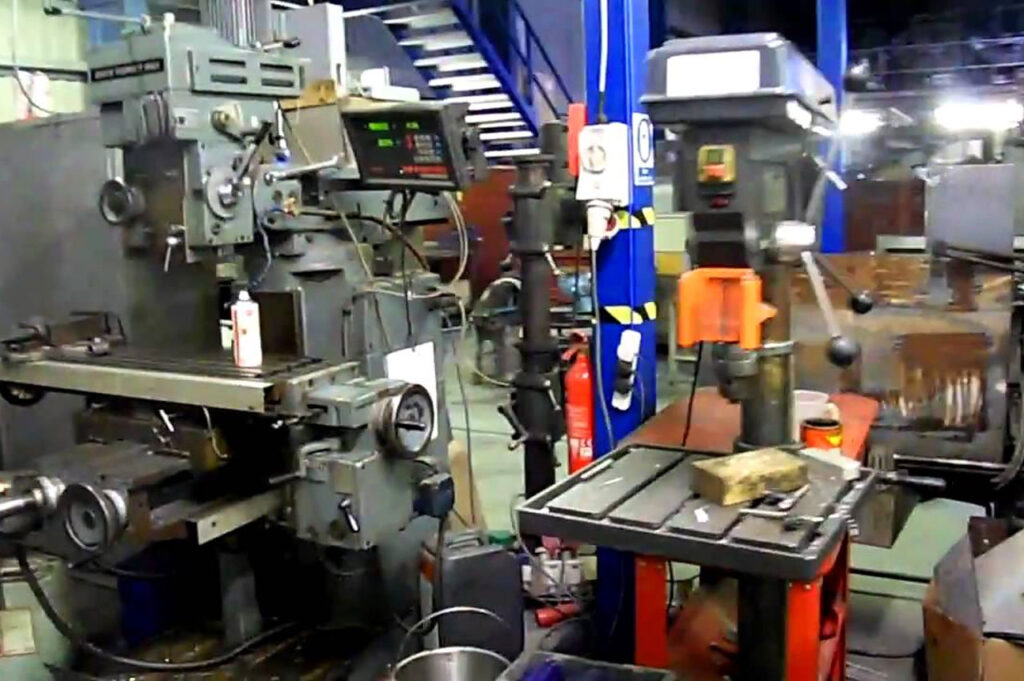

Plant and Machinery Insurance policy typically provides coverage for physical loss or damage to various types of machinery and equipment used in businesses, such as factories, workshops, and manufacturing facilities. The coverage may include:

- Accidental damage: The policy typically covers accidental damage to plant and machinery caused by fire, lightning, explosion, theft, impact damage, and natural disasters such as storms and floods.

- Breakdown: The policy may also cover breakdown of machinery due to mechanical or electrical failure, which can lead to business interruption and financial losses.

- Repair and replacement: In case of damage or breakdown, the policy may cover the cost of repairs or replacement of the machinery.

- Deterioration of stock: Some policies may also provide coverage for damage or spoilage of stock due to a breakdown of refrigeration or cooling systems.

It is important to note that the coverage provided under the policy may vary depending on the insurer and the specific terms and conditions of the policy. It is recommended to carefully review the policy documents and seek clarification from the insurer if there are any doubts or concerns.

Plant and Machinery Insurance Policy provides several benefits to businesses that rely heavily on machinery and equipment. Here are some of the key benefits:

- Protection against financial losses: Plant and Machinery Insurance policy provides protection against financial losses due to damage or breakdown of machinery, which can result in costly repairs, replacement or business interruption.

- Peace of mind: Knowing that your machinery is insured can give business owners peace of mind, allowing them to focus on other aspects of the business without worrying about the financial impact of a potential loss.

- Compliance with legal requirements: Some industries and countries require businesses to have insurance coverage for plant and machinery, to ensure compliance with legal requirements.

- Customizable coverage: Plant and Machinery Insurance policy can be tailored to the specific needs of a business, with options to cover various types of machinery and equipment, as well as additional coverage for business interruption, deterioration of stock, and more.

- Enhanced business reputation: Having Plant and Machinery Insurance policy in place can enhance the reputation of the business, demonstrating to customers, investors, and stakeholders that the business is well-prepared for unexpected events that may impact its operations.

Overall, Plant and Machinery Insurance policy can provide businesses with the protection and peace of mind they need to focus on their operations and growth