DETERMINATION OF EXCHANGE RATE IN A FREE MARKET, MERITS AND DEMERITS OF FLEXIBLE AND FIXED EXCHANGE RATE

Exchange rates are determined by the market forces of supply and demand in a free market. In a free market, the exchange rate of a currency is determined by its supply and demand, which are affected by various economic factors such as inflation, interest rates, economic growth, and political stability.

Merits of Flexible Exchange Rate:

1. Automatic Adjustment: In a flexible exchange rate regime, the exchange rate automatically adjusts to changes in market conditions. This helps to restore equilibrium in the balance of payments and helps to avoid persistent trade imbalances.

2. Market-Based System: A flexible exchange rate regime is based on market forces of supply and demand, which ensures that the exchange rate reflects the true value of a currency in the international market. This provides transparency and reduces the risk of government manipulation.

3. Independent Monetary Policy: In a flexible exchange rate regime, a country can have an independent monetary policy that suits its domestic needs. The central bank can use its monetary policy tools to manage inflation, unemployment, and other macroeconomic variables without worrying about the exchange rate.

Demerits of Flexible Exchange Rate:

1. Volatility: The exchange rate under a flexible regime is volatile and can fluctuate widely due to changes in market conditions. This can lead to uncertainty and instability for businesses and investors.

2. Speculation: A flexible exchange rate regime can encourage speculation in the currency market, which can further increase volatility and make it difficult for businesses to plan their investments.

3. Currency Misalignment: In a flexible exchange rate regime, the exchange rate may not always reflect the true value of a currency, leading to currency misalignment. This can create distortions in trade and investment flows, leading to economic imbalances.

Merits of Fixed Exchange Rate:

1. Stability: A fixed exchange rate regime provides stability and certainty in the exchange rate, which can promote trade and investment. Businesses can plan their investments without worrying about exchange rate fluctuations.

2. Inflation Control: A fixed exchange rate regime can help to control inflation by limiting the flexibility of the central bank to print money. This helps to anchor inflation expectations and maintain price stability.

3. Reduced Speculation: A fixed exchange rate regime can reduce speculation in the currency market, which can help to stabilize the exchange rate.

Demerits of Fixed Exchange Rate:

1. Limited Flexibility: A fixed exchange rate regime limits the flexibility of the central bank to respond to changing economic conditions. This can lead to a loss of control over domestic monetary policy.

2. Currency Crisis: A fixed exchange rate regime is vulnerable to currency crises if there is a sudden shift in market conditions or if the central bank is unable to maintain the exchange rate. This can lead to a loss of confidence in the currency and can have severe economic consequences.

3. Misallocation of Resources: A fixed exchange rate regime can lead to a misallocation of resources if the exchange rate does not reflect the true value of the currency. This can create distortions in trade and investment flows, leading to economic imbalances.

FOR MANY MORE UPDATES AVAILABLE CLICK BELOW

CLICK THE BELOW LINK TO READ THE COMPLETE CONTENTS

SOME CONTENTS OF THIS WEBSITE ARE FOR GOLD SUBSCRIBERS ONLY.

Join us as a GOLD SUBSCRIBER and get access to read important books.

KIND ATTENTION

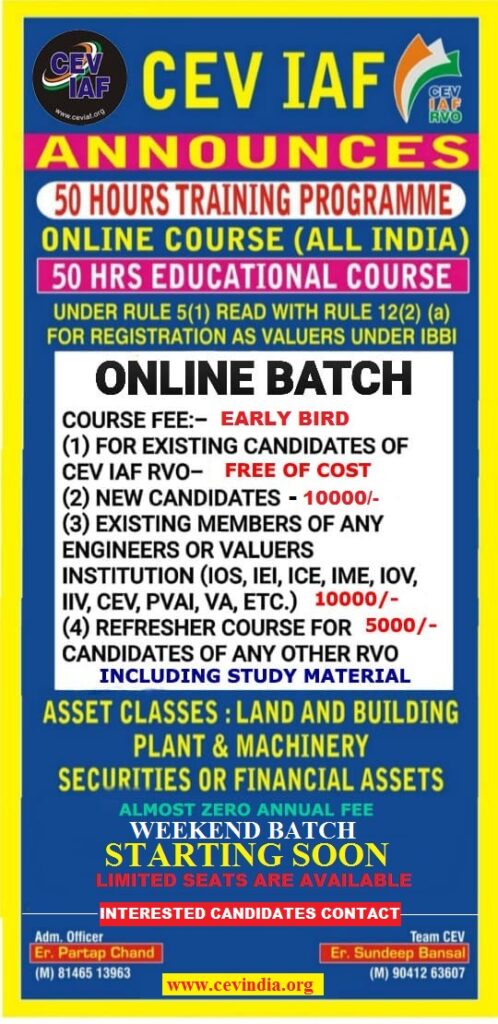

We are going to close all what’s groups of CEV soon due to difficulties in posting information or message in more than 5 groups of CEV at a time.

All future posts of empanelment notices & professional importance will be shared on

1. https://t.me/+dbHNkNO22xsyYTY1

2. www.valuerworld.com

3. The Twitter handle of CEV India

https://twitter.com/cevindia?t=XbqlvnwUVz1G3uPgs749ww&s=09

after closing the groups.

All members of these groups are requested to register themselves at the following link immediately for Getting all related timely updates.