ANNUAL SINKING FUND WORKING

An annual sinking fund is a financial strategy used by businesses or organizations to set aside a certain amount of money each year to pay off a debt or to fund a future expense, such as the replacement of equipment or facilities.

The working of an annual sinking fund involves the following steps:

1. Determine the amount needed: The first step in setting up an annual sinking fund is to determine the amount of money needed to pay off a debt or to fund a future expense. This requires a careful analysis of the anticipated cost and the time frame for the payment or funding.

2. Set up the fund: Once the amount is determined, the next step is to set up the sinking fund. This involves creating a separate account or fund within the organization’s financial structure.

3. Determine the contribution amount: The next step is to determine the amount of money that needs to be contributed to the sinking fund each year. This amount is based on the total amount needed and the number of years until the payment or funding is due.

4. Make annual contributions: Once the contribution amount is determined, the organization makes annual contributions to the sinking fund. These contributions can be made in a lump sum or in regular installments.

5. Manage the fund: The sinking fund is managed by the organization’s financial team, who invest the money in a low-risk investment vehicle such as bonds, mutual funds, or government securities. The goal is to earn a modest return while ensuring that the principal is secure.

6. Use the fund: When the payment or funding is due, the organization uses the sinking fund to make the payment or fund the expense. This ensures that the organization is prepared for the expense and does not have to borrow money or incur debt to pay for it.

Overall, the annual sinking fund working provides a sound financial strategy for businesses and organizations to manage debt and future expenses, and to ensure financial stability and security over the long term.

Here’s an example of how an annual sinking fund can work:

Let’s say a company wants to replace its manufacturing equipment in 10 years, and the total cost of the equipment replacement is expected to be $1,000,000. The company decides to set up an annual sinking fund to save for this expense.

Step 1: Determine the amount needed The company needs to save $1,000,000 over 10 years, so the annual savings required is $100,000.

Step 2: Set up the fund The company creates a separate sinking fund account within its financial structure.

Step 3: Determine the contribution amount The contribution amount is $100,000 per year, which will be invested in a low-risk investment vehicle.

Step 4: Make annual contributions The company contributes $100,000 to the sinking fund each year for 10 years, for a total contribution of $1,000,000.

Step 5: Manage the fund The financial team invests the money in a low-risk investment vehicle such as bonds, mutual funds, or government securities, earning a modest return while ensuring that the principal is secure.

Step 6: Use the fund After 10 years, the company has accumulated $1,000,000 in the sinking fund, and can use this money to pay for the equipment replacement without having to borrow or incur debt.

By using an annual sinking fund, the company was able to save for a major expense over time, without incurring significant debt or disrupting its cash flow.

FOR MANY MORE UPDATES AVAILABLE CLICK BELOW

CLICK THE BELOW LINK TO READ THE COMPLETE CONTENTS

SOME CONTENTS OF THIS WEBSITE ARE FOR GOLD SUBSCRIBERS ONLY.

Join us as a GOLD SUBSCRIBER and get access to read important books.

KIND ATTENTION

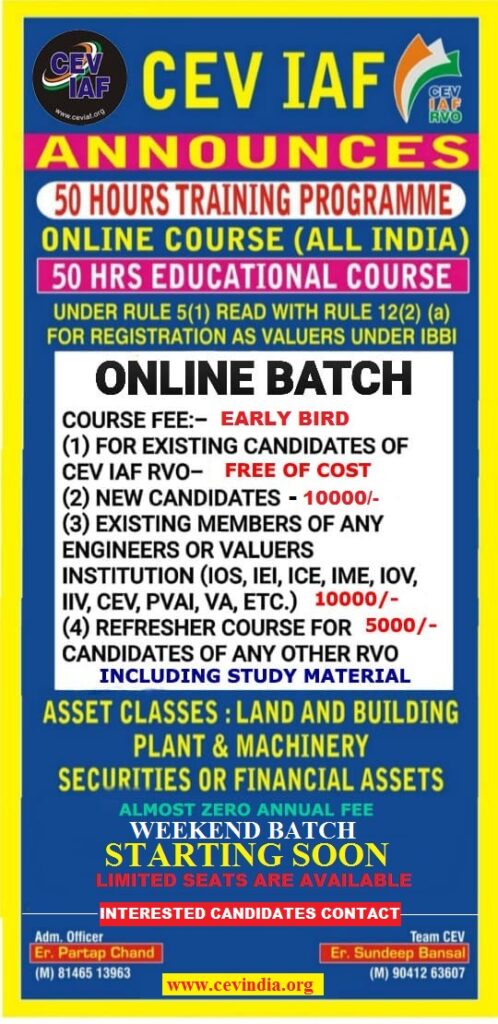

We are going to close all what’s groups of CEV soon due to difficulties in posting information or message in more than 5 groups of CEV at a time.

All future posts of empanelment notices & professional importance will be shared on

1. https://t.me/+dbHNkNO22xsyYTY1

2. www.valuerworld.com

3. The Twitter handle of CEV India

https://twitter.com/cevindia?t=XbqlvnwUVz1G3uPgs749ww&s=09

after closing the groups.

All members of these groups are requested to register themselves at the following link immediately for Getting all related timely updates.