LAND REGISTRATION

VALUATION OF BUILDINGS IS MANDATORY

The Kerala government ordered that the value of buildings must be given on title deeds for all land transactions. As per the rule, the land will be registered after documenting the exact value of the building But it is observed that nobody is following this rule.

As the government made it mandatory to strictly follow the rule for all land transactions, the registration department benefited during the last financial year. Income from this also increased the revenue of the department.

Approved engineers must examine the building and issue an evaluation certificate for completing the land registration. With this, 8 percent of stamp duty and 2 percent of the registration fee must be paid for buildings during land registration.

The Kerala Stamp Act directs that the value of buildings must be assessed based on Public Work Department’s rate and must be added while registering title deeds. Earlier, this rule was made mandatory for flats and apartments. Gradually, all buildings, except palm-thatched huts, have been brought under this.

Years ago, the government had issued an order to make the valuation certificate of PWD mandatory for land registration. But people and officials continued to violate the rule. In some places, the value of buildings was marked as Rs 50 per square foot on title deeds. After noting this illegal practice, the registration department gave strict directions to registrars.

Following this, landowners started to add the exact value of buildings while registering title deeds.

COMPLAINTS ON DETERMINING THE VALUE OF BUILDINGS

Meanwhile, many people have raised complaints about assessing the value of buildings on their land. While determining the price, the age of the building must be considered. Sometimes, there is a delay in estimating the value when the buildings do not have a number.

Engineers approved by the registration department are refusing to issue valuation certificates fearing action from the department over lapses. Though the department identified over 3000 engineers for this purpose, only 800 are issuing these certificates.

REGISTRATION DEPARTMENT

NOTIFICATION

AMENDMENT

In the said notification,- …

1. after the words “Local Self Government Institution concerned” the words, “or the Public Works Department or the Irrigation Department or the Kerala Water Authority, or Chartered Engineers or Approved Valuers or Registered Valuers or Registered Architects /Engineers” shall be inserted….

PERFORMA OF VALUATION CERTIFICATE

Land fair value in Kerala state

The fair value of land in Kerala is the valuation set by the Kerala Government upon the District, Taluk, Village and RDO. It’s the calculation laid on facilities and transportation growth in that particular District or Taluk. When registering a property the registration charges and the stamp duty are calculated based on the fair value of that particular land. This value is meant to be revised periodically as per market value and fair value in Kerala.

The details of the schedule of property, buyer and seller details along with their transaction value on stamp paper will be displayed while registering property or land. Once the paperwork is done the stamp duty and registration charges are calculated based on the fair value of land/property. In most cases, the fair value will be lower than the market value based on various calculations.

The fair value system has divided land in Kerala into 15 categories on the basis of its location and access to the public roads. Each category has given a minimum value level and the stamp duty for registering the property will be on the basis of this value.

The major 15 categories based on location are as follows

Commercially Important Plot, Residential Plot with NH, PWD Road access, Residential Plot with Corporation, Municipality, Panchayath Road Access, Residential Plot with Private Road Access, Residential Plot without Vehicular Access, Garden Land with Road Access, Garden Land without road access, Coastal Belt, Water Logged Land, Rocky Land, Waste Land, WetLand, Hill tract with road access, Hill tract without road access and Government Property.

The latest news on the fair value of land in Kerala

As per the latest order from the Kerala government on 12th February 2021, the property tax in Kerala is to be linked with the fair value of land in Kerala.

The Urban Affairs Department has prepared a fair list of rates concerning basic tax and fair value of the various categories of buildings like commercial, residential, educational, industrial, theatres, hospitals, resorts, assembly buildings, mobile towers, amusement parks and resorts.

The tax rates are being decided based on the fair value of the property & are fixed for commercial buildings in the ranges of 100 square meters, 100-200 square meters and another category of above 200 square meters.

In earlier calculations, the buildings were being assessed based on the property’s rental value on an annual basis. Later on, a new regime was introduced where the tax was collected based on plinth area.

In February of 2020, the government of Kerala announced a certain hike in the land’s fair value by 30% in several areas where large-scale projects were identified. The entire exercise attracted more and more revenue from the payable stamp duty on property transactions. Several realtors have been opposing and protesting this move of the Kerala government as the total construction cost went up considerably.

List of fair value for few prominent places:

|

District |

Locality |

Fair Land Value (INR Per sq. yard) |

Ward-Block |

Classification |

|

Thiruvananthapuram |

Chirayinkeezhu |

40,000 |

41 |

Coastal belt |

|

Kollam |

Karunagappally |

300,000 |

5 |

Coastal belt |

|

Pathanamthitta |

Adoor |

32,110 |

9 |

Commercially important plot |

|

Thiruvananthapuram |

Kallara |

200,000 |

14 |

Commercially important plot |

The fair value of land Kerala: How to check?

To check the fair value of land, follow this step-by-step procedure:

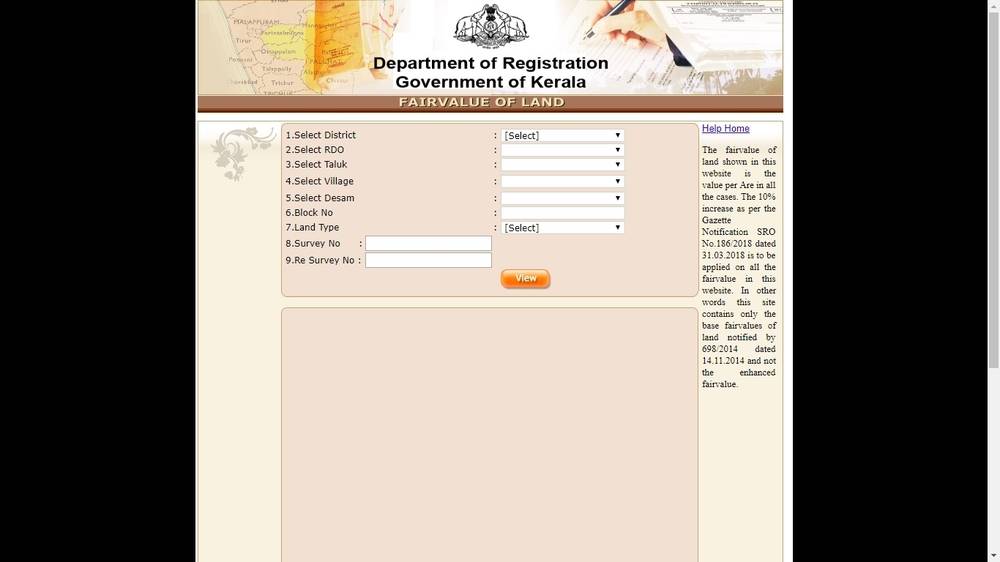

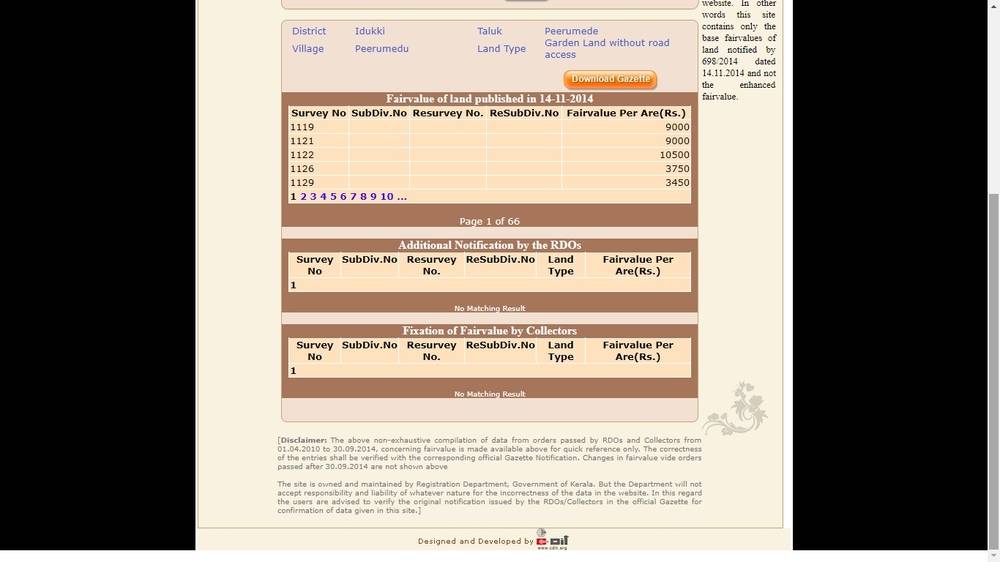

Step 1: Visit IGR Kerala Portal and prepare all the information being asked to check the land value in Kerala.

Step 2: Select the district, RDO, taluk, and village from the drop-down menu, as these are mandatory fields for going about Kerala land fair value search.

Step 3: Now select Desam, land type, block number, survey number and other requisite information. These are not mandatory fields for checking land value in Kerala.

Step 4: Click on ‘View Fair Value’ and you will be redirected to a new page, where the results of the Kerala land fair value search will be displayed on the screen.

Please note, that these Kerala land fair value searches were last updated as per the notification published on March 31, 2020. Also, as per the disclaimer given by the IGR Kerala, the department is not responsible for the incorrectness of the data on the website. Therefore, all users should verify the original notification issued by the RDOs/collectors, for confirming the rates mentioned on this website.

Know more about the registration department Kerala and online property services

The fair value of land in Kerala and market value: Differences

The land value in Kerala or property is fixed by the state authorities. The market value is set by the marketplace, based on the overall demand and supply scenario. Usually, fair value of land in Kerala is considered for stamp duty and registration of deeds, if the declared transaction value is lower than the fair value of land. In other cases, the consideration amount or Kerala land fair value, whichever is the higher amount, is used to calculate stamp duty and registration charges in Kerala.

The fair value of land: Applicability

In transactions where the sale deed was executed by the parties prior to the revision of the Kerala land fair value, the valuation only needs to be done as per the land fair value existing on the date of execution of the document and the stamp duty for the purpose of registration will be calculated accordingly.

The fair value of land: Stamp duty and registration charges in Kerala

|

Gender |

Stamp duty rates |

Registration charges |

| Male | 8% | 2% |

| Female | 8% | 2% |

| Joint (Male + Female) | 8% | 2% |

| Joint (Male + Male) | 8% | 2% |

| Joint (Female + Female) | 8% | 2% |

The stamp duty in Kerala is levied on the fair value of Kerala/ fair value of land Trivandrum or the value of the consideration (declared property transaction value, as on the sale agreement and sale deed), whichever is higher. For example, if the fair value of land or property is Rs 70 lakh and the consideration value is Rs 65 lakh, then, the stamp duty and registration charge will be calculated on the fair value.

Here’s how to pay stamp duty and registration charges in Kerala

Land tax in Kerala

Now, landowners in Kerala can easily pay the land tax online in a few simple steps. The Kerala Revenue Department has introduced a web-based application for revenue, integrated with registration. The app, Revenue Land Information System (ReLIS) can be used to make the payment, where users can register and pay their land taxes online. They can also get a soft copy of the payment receipt.

How much is a land tax in Kerala

| Area | Extent | Rate |

| Corporation | Up to 2 acres | Rs 2 per acre |

| Above 2 acres | Rs 4 per acre | |

| Municipality/ township | Up to 6sacres | Rs 1 per acre |

| Above 6 acres | Rs 2 per acre | |

| Panchayat | Up to 20 acres | Rs 0.50 per acre |

| Above 20 acres | Rs 1 per acre |

You can calculate the exact rate of land tax by contacting the local tehsildar office or through the revenue services portal.

How to pay land tax online in Kerala

- Visit the Revenue e-Services portal and register yourself. Login once you have registered.

- Go to New Request and select the ‘Land Tax’ option.

- Fill in all necessary details.

- Click the ‘View and Add’ button and make sure the details are correct.

- Click to submit the request.

- An approval message will be sent to the registered mobile after verification of the submissions.

- After receiving the approval message, log in and select My Request and click the ‘Pay Now’ button.

- You can download the receipt after paying the amount.

- To pay taxes in subsequent years, after signing in, select the ‘Transaction History’ menu, and click the Pay Now button.

The fair value of land in Kerala: Latest news

Property tax in Kerala to be linked with the fair value of land

According to the latest Kerala gazette notification of land fair value 2021, the property tax assessment in urban local bodies in Kerala will soon be linked to the fair value of the land. The Local Self-government Department notified the reassessment, through an order issued on the fair value of land in Kerala 2021.

The Urban Affairs Department has prepared a list of basic tax rates and fair values for buildings of various categories, like residential purpose, commercial purpose, industrial purpose, educational purpose, hospitals, theatres, assembly buildings, resorts, amusement parks, and mobile towers.

The basic tax rate based on fair value of land in Kerala 2021, has been fixed for buildings for commercial purposes in the range up to 100 sq m, above 100 sq m and up to 200 sq m, and above 200 sq m.

Earlier, buildings were assessed, based on the annual rental value. Later, a new regime was introduced in which the tax was collected based on the plinth area.

In February 2020, the Kerala government announced a hike in the fair value of land by up to 30%, in areas where large-scale projects had been identified. The entire fair value of land in the Kerala 2020 exercise will attract more revenue from stamp duty payable on property transactions. A lot of realtors have been opposing and protesting the move, as the total cost of construction would go up considerably. Industry experts say the decision to hike fair value is a retrograde step, further pulling down an industry that has been struggling, post-demonetization, the floods, the employment crisis in the Middle East, and now, the Coronavirus pandemic.

Apart from this, regular home buyers who buy plots for house construction would have to shell out extra for purchasing the land.

https://igr.kerala.gov.in/

The fair value of land shown on this site is the enhanced fair value as per Gazette notification SRO No.305/2022 dated 30/03/2022. In other words, this site includes the enhanced fair value as per the Gazette notifications published till 30/03/2022.

[Disclaimer: The site is owned and maintained by the Registration Department, Government of Kerala. But the Department will not accept responsibility and liability of whatever nature for the incorrectness of the data in the website. In this regard the users are advised to verify the original notification issued by the RDOs/Collectors in the official Gazette for confirmation of data given in this site.]

Kerala Land Valuation Certificate

State Government sets the fair value of land in Kerala from time to time. Property registration charges and stamp duty are calculated based on the fair value of land maintained by the Kerala Government. Property value supported by the Government is revised periodically as per market value and fair value. A valuation certificate is used to prove the fair value of property in a particular District and Taluk. In this article, we look at the procedure for obtaining a land valuation certificate for a property in Kerala.

Importance of Land Valuation Certificate

A land valuation certificate is an important document to prove the value of property in a particular area. Also, the valuation certificate has to be submitted to get a bank loan. A recommendation for all landowners is to check and obtain a land valuation certificate every 3 to 5 years.

Fair Value of Land

The fair value of land is calculated and notified by the Kerala Government. It is evaluated based on the type of road, the importance of the plot, road access, and the nature of the land. In Kerala fair value of land can be checked on the Kerala Government Department of Registration webpage following the steps below:

Click on Fair value of Land. In the new page, select District, RDO, Taluk, survey number and village.

The fair value of the particular property will appear.

Documents Required

The following documents are necessary for obtaining the land valuation certificate:

- Identity Proof – Aadhaar Card

- Address Proof – Voters ID

- Proof of ownership of property

- Encumbrance certificate

- Land Tax Details

Processing Time

The issuance of the valuation certificate will take place within 15 days from the date of application.

Validity of Valuation Certificate

A valuation certificate is valid only for a specified minimum period.

Government Fees

- Akshaya Centre Charges – Rs. 28 (For SC or ST family Rs.12 and BBP family – Rs.20)

- Kerala e-district online charges – Rs.15

Applying for a Valuation Certificate through Akshaya Centers

To apply for a land valuation certificate through the Akshaya centre, follow the below-mentioned steps:

Step 1: Visit the nearest Akshaya Centre.

Step 2: Complete all details in the application and apply the Akshaya centre service operator along with the application fee.

Step 3: Get a receipt from the operator. It will contain an application number.

Note: The applicant will receive an SMS to the registered mobile number regarding the progress of the valuation certificate application.

Step 4: Revisit the Akshaya center after receiving a “certificate issued” SMS.

Step 5: The applicant can download and print the digitally signed valuation certificate with the help of the service operator.

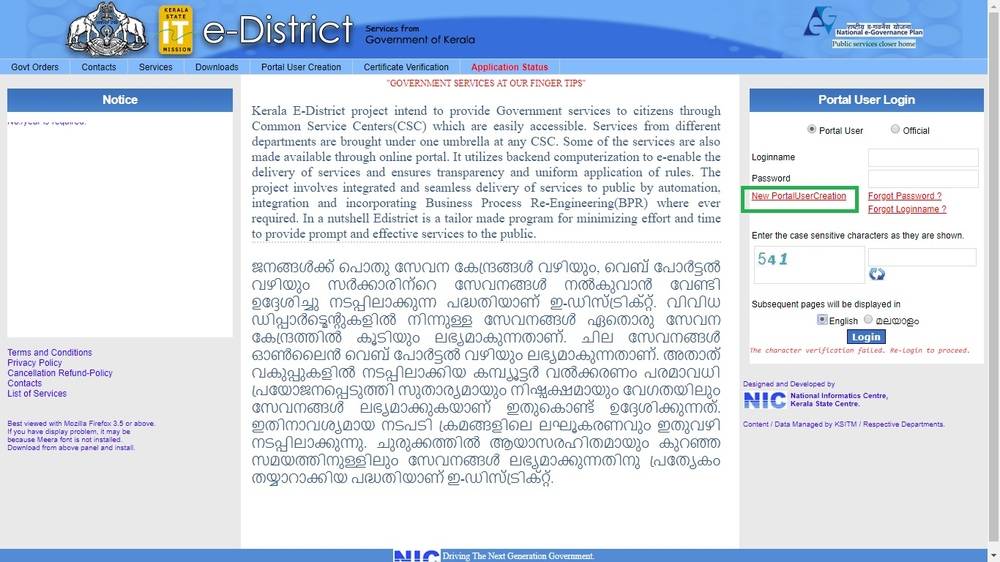

Applying Online through the e-District Portal

Follow the below-mentioned steps to apply for a land valuation certificate through the e-District portal:

Step 1: Visit the homepage of e-District Kerala.

Step 2: To avail of certificate services in this portal, the applicant needs to register.

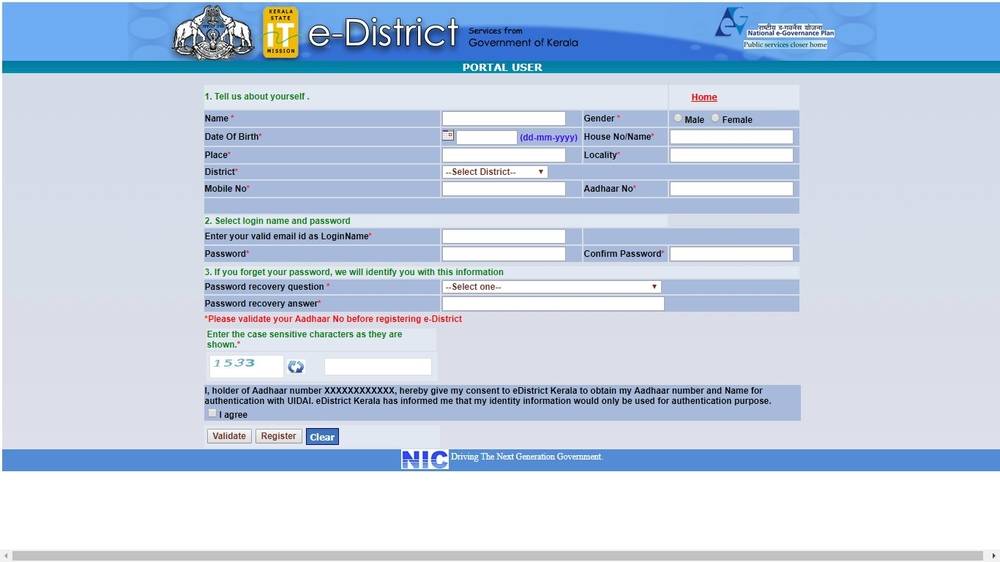

User Registration

Step 3: Click on the new portal user creation option. In this page, the applicant will have to provide personal details for e-District registration.

Step 4: Enter the DOB, Gender, Place, House number, Locality, Mobile number and Aadhaar number. Select the login name and password. Select any one password recovery question and write an answer to this question.

Note: If the applicant forgets the password, the e-portal will identify the applicant with this information and they can recover the password.

Step 5: Enter the case-sensitive characters shown in the captcha image. The applicant needs to click on validate if all entered information is correct click on register.

Login to the Portal

Step 6: Login into the e-district web portal using the username and password after registration to avail of certificate services.

One Time Registration

Step 7: One-time registration can be done by clicking the ‘one-time registration’ option. The applicant has to enter all the details and click on the duplicate button.

Note: Duplicate verification will find out if the applicant has already registered through any Akshaya Centers. After successful completion of the duplicate check, the ‘submit’ button will be enabled.

Step 8: Now click on submit button. The applicant can edit the registered details later using ‘Edit Registration’.

Step 9: Click Applicant registration the link will go to the next page. Click on submit.

Step 10: After the completion of the registration, select “apply for certificate” and then click on get started.

Follow the below three-stage process to apply valuation certificate online:

Application Detail Section

Step 11: Enter the e-District register number. Select certificate type as valuation certificate and certificate purpose from the drop-down menu.

Step 12: Enter the name and select self from the relationship drop-down menu and click on save.

Attachment Section

Step 13: The applicant has to upload all required documents in PDF format.

Step 14: Once the applicant has uploaded all the documents, they can make payment. Check the entered detail and select payment.

Pay Fee and Get Receipt

Step 15: Pay fee for the valuation certificate.

Step 16: After successful payment of the fee, the applicant will redirect to the acknowledgment page. Now the applicant can take a printout of this receipt and valuation application.

The applicant can check the status of the application in the “transaction history” in the e-portal. The applicant will receive an SMS to the registered mobile number regarding the progress of the valuation certificate application.

Download Valuation Certificate

Step 17: After receiving the “certificate approved or issued” SMS on the mobile number, login into the e-District portal again and take a printout of the digitally signed valuation certificate.