Capitalization: Capitalization is any method used to convert an income stream into value. There are two primary income capitalization methods: direct capitalization and yield capitalization. (A capitalization rate is any rate used to convert an estimate of future income into an estimate of market value.

Direct Capitalization is a method used to convert an estimate of a single year’s income expectancy into an indication of value in one direct step. Dividing the income estimate by an appropriate rate or by multiplying the income estimate by an appropriate factor converts the income stream into an estimate of value. In essence, direct capitalization expresses value as a relationship between income and a rate or multiplier. The direct capitalization technique employs capitalization rates and multipliers extracted from comparable sales.

Yield Capitalization is a capitalization method used to convert future benefits into present value by discounting each future benefit at an appropriate yield rate. The future benefits may also be discounted by developing an overall capitalization rate that explicitly reflects the investment’s income pattern, value change, and yield rate. As such, this method is also known as the discounted cash flow (DCF) model. The yield rate represents the multi period rate of return that an investor would expect when investing in the property given the risk of the income stream. Yield capitalization explicitly considers the size, shape, and duration of the income stream and any change in the value of the property. Future income is discounted using the

present value factors.

Rate of Capitalization:

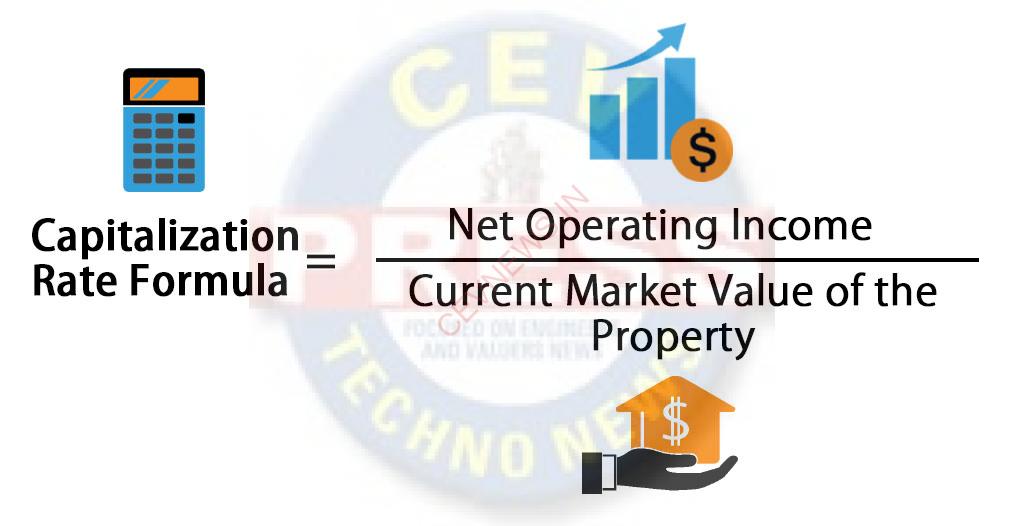

The capitalization rate, often just called the cap rate, is the ratio of Net Operating Income (NOI) to property asset value. So, for example, if a property recently sold for Rs.1, 00, 00, 000 and had an NOI of Rs.10,00,000 then the cap rate would be Rs.1, 00, 00, 000/Rs.10, 00, 000 or10%.

Capitalization Rate = Net operating Income/Current Market Value

where,

The net operating income is the (expected) annual income generated by the property (like rentals) and is arrived at by deducting all the expenses incurred for managing the property. These expenses include the cost paid towards the regular upkeep of the facility as well as the property taxes.

The current market value of the asset is the present-day value of the property as per the prevailing market rates.In another version, the figure is computed based on the original capital cost or the acquisition cost of a property.