Buying a holiday or second home in the lap of nature remains an attractive real estate investment proposition. Himachal Pradesh is one such destination that is gaining prominence and emerging as a sought after location for investment because of its proximity to the national capital and to Chandigarh. There is an increased interest among high net worth individuals and professionals with high incomes for property in the state.

Until recently, there was a lot of confusion on the legality of buying property in this state. The Himachal Pradesh Apartment and Property Regulation Act, 2005, permits non-domiciles to buy a plot of land or apartment from a licensed builder without seeking any approvals from the government. However, there is a restriction on non-agriculturist buying land used for agriculture purposes. Any person who does not own agricultural land in Himachal Pradesh is a non-agriculturist.

According to Rule 38 A (3) of the Himachal Pradesh Tenancy and Land Reforms Rules 1975, there are permissible limits on different purposes for acquiring land. For example, the limit building a residential house is 500 square metres.

Famous tourist destinations like Shimla, Solan and Kasauli offer a variety of properties for investment in the form of villas, bungalows and apartments. The prices for mid-range apartments range between Rs 2,500-5,000 per sq ft in these cities. Studio apartments and 1 BHK apartments are the favourite investment type in these locations as they are fully furnished.

Generally, these apartments also provide management services; this is an option that is available by paying extra. Areas of these apartments vary between 600 and 1,100 sq ft. However, premium options are also available for those who want to invest in luxury projects.

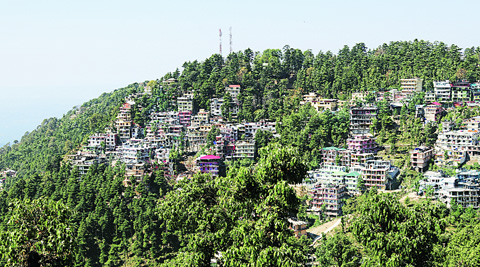

Shimla, the capital, was the first to witness real estate development. Various projects are developed by the local government authority, Himachal Pradesh Urban Development Authority (HIMUDA) and local developers in Shimla. Prominent developers such as DLF, have also launched luxury housing projects in Shimla. However, Shimla is now getting congested and there are limited options available near the city centre. Projects located farther away are not preferred as these locations lack basic amenities and infrastructure.

Recently, Solan, the second most populous city in Himachal Pradesh, has also emerging as a favoured investment destination because of its strategic location on the Kalka-Shimla National Highway 22. The town is situated between Chandigarh and Shimla and is equidistant from various other tourist spots like Kasauli, Kullu, Manali, and Chail. Unlike Shimla, Solan provides a variety of options in the lap of nature with many basic amenities available.

Tata Housing, DLF and Woodside Developments are the prominent national developers who have launched luxury projects in Kasauli, Solan district. Myst by Tata Housing is a luxurious duplex villa project, priced in the range of Rs 3.7-8 crore. DLF Samavana, is an “invitation only” project consisting of plots, villas and apartments priced anywhere between Rs 1.7-8.5 crore. Woodside Developments is close to completing a project in Kasauli with 35 villas of 2,800 – 5,000 sq ft. Private equity fund, Fire Capital, has also entered the sector with a luxury apartment project called Clouds’ End in Kufri, where apartment sizes have been deliberately kept small to bring the ticket size down to Rs 60 lakh-Rs 1.5 crore.

Besides holiday homes, these cities are also attracting the interest of developers of retirement homes. The natural, scenic surroundings make it a perfect location for retirement homes for those who want to spend the rest of their lives away from the city’s hustle and bustle.

Whether you are buying a holiday home, retirement home or second home in these areas, be sure you know what you are getting into. One should be sure of the title of the property, security and maintenance to enjoy a hassle-free ownership experience. The location should be one that is easily accessible with basic amenities available within a periphery of 0.5-1 km. So long as these conditions are satisfied, one can expect decent returns by investing in these areas over the long term.

The author is Associate Director, Colliers International