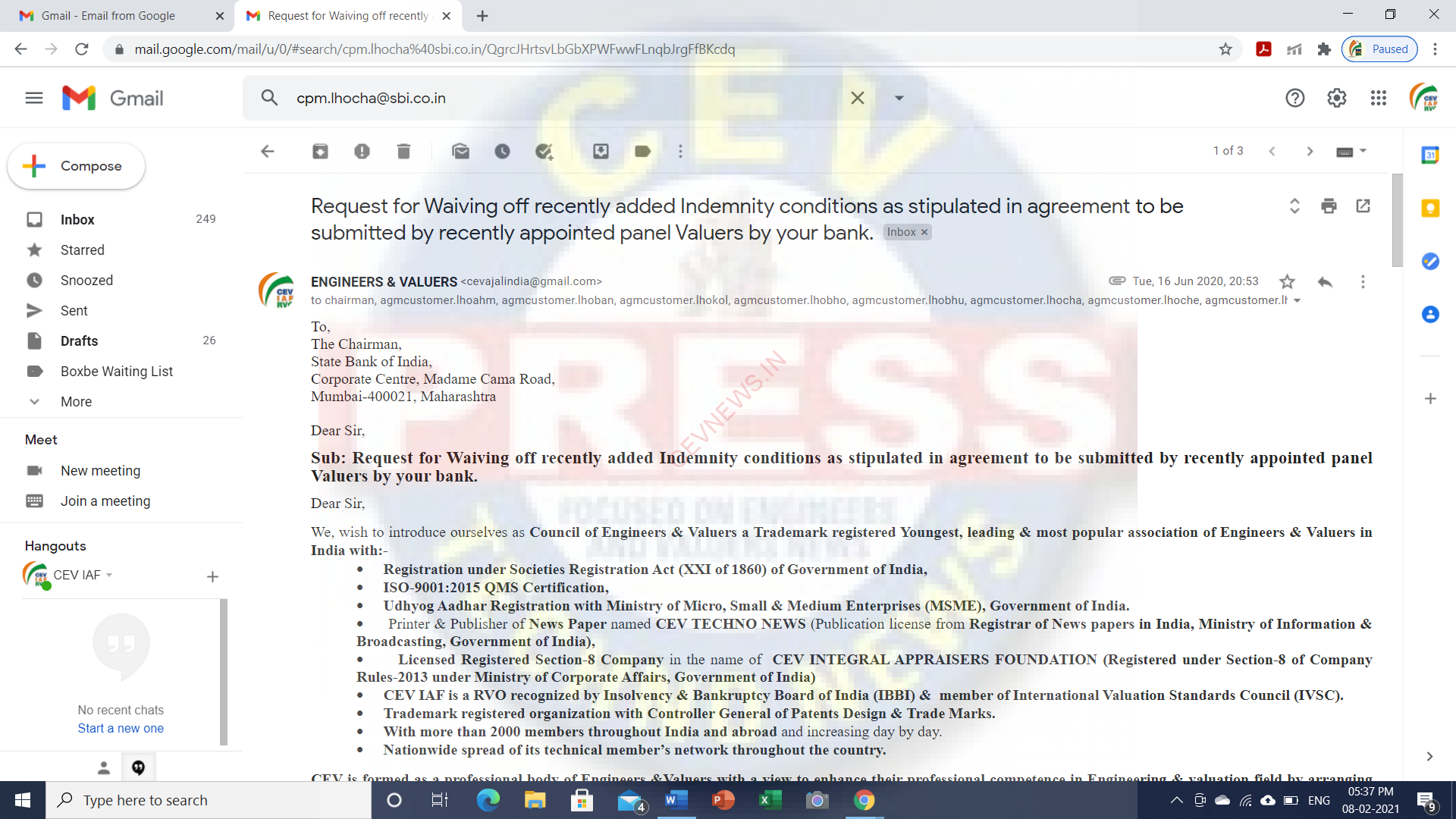

CEV sent protest letter TO PNB & SBI Requesting for Waiving off recently added Indemnity conditions as stipulated in agreement to be submitted by recently appointed panel Valuers by the bank.

TECHNO JOURNALIST JALANDHAR: Dr Rajwinder Singh President of Council of Engineers & Valuers (the most popular, youngest, dynamic & charitable organization working for welfare & professional upliftment of Engineers & Valuers in India serving the nation) told today in a special interview that “the issue of signing indemnity bond is very dangerous on behalf of Individual Valuer an is against the constitution. They have written various letters to PMO, SBI, SIDBI & PNB Requesting for Waiving off recently added Indemnity conditions as stipulated in the agreement to be submitted by recently appointed panel Valuers by the bank.”

He requested all Valuers professionals & organizations to come forward on this issue to support us on this issue which is directly related to our livelihood & survival existence.

On the special request of all the stakeholders of this ecosystem, he has agreed to publish these letters for the sake of the betterment of the profession.

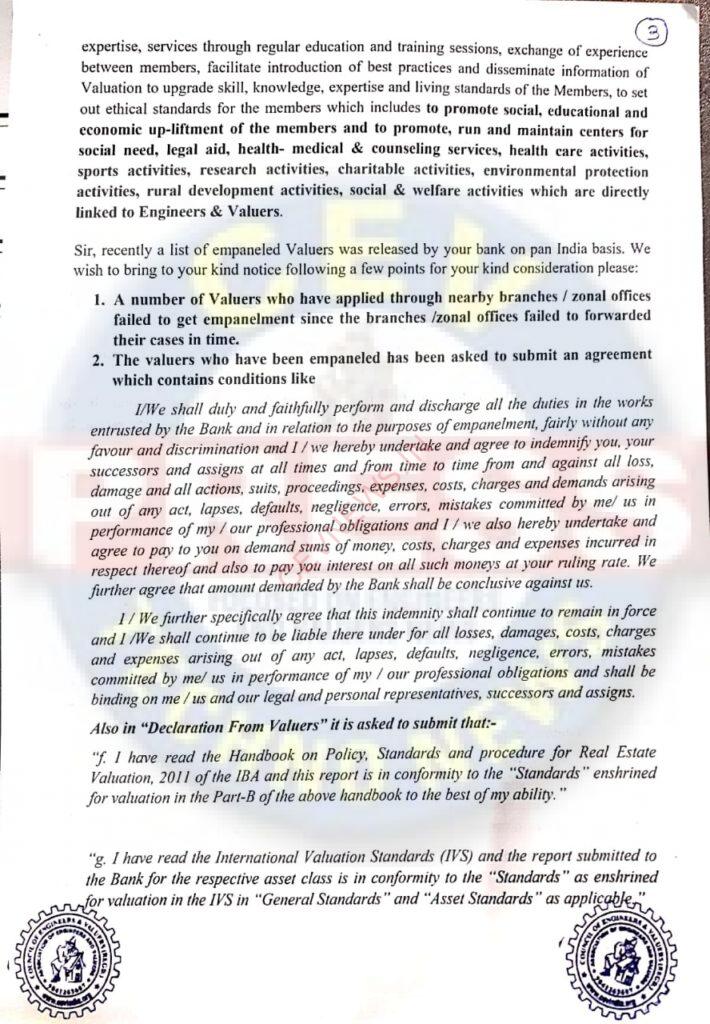

He said, recently a list of empaneled Valuers was released by Punjab National Bank on pan India basis. We wish to bring to everyone’s notice the following a few points for your kind consideration please:

-

A number of Valuers who have applied through nearby branches / zonal offices failed to get empanelment since the branches /zonal offices failed to forward their cases in time.

-

The valuers who have been empaneled has been asked to submit an agreement that contains conditions like

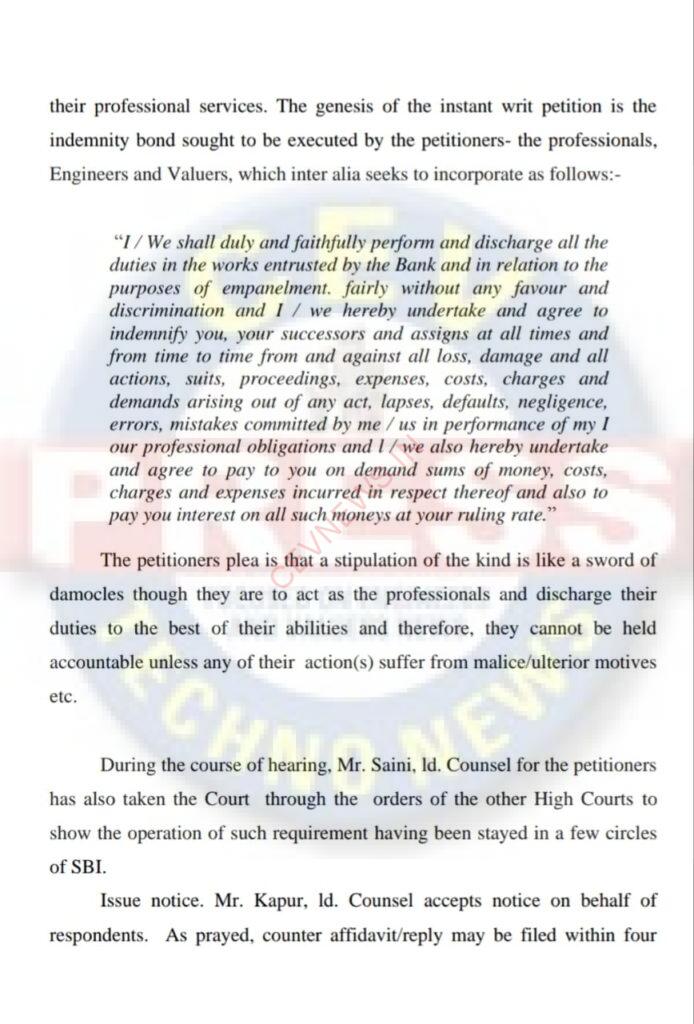

I/We shall duly and faithfully perform and discharge all the duties in the works entrusted by the Bank and in relation to the purposes of empanelment, fairly without any favour and discrimination and I/we hereby undertake and agree to indemnify you, your successors and assigns at all times and from time to time from and against all loss, damage and all actions, suits, proceedings, expenses, costs, charges and demands arising out of any act, lapses, defaults, negligence, errors, mistakes committed by me/ us in performance of my / our professional obligations and I/we also hereby undertake and agree to pay to you on-demand sums of money, costs, charges and expenses incurred in respect thereof and also to pay you interest on all such money at your ruling rate. We further agree that amount demanded by the Bank shall be conclusive against us.

I / We further specifically agree that this indemnity shall continue to remain in force and I /We shall continue to be liable thereunder for all losses, damages, costs, charges and expenses arising out of any act, lapses, defaults, negligence, errors, mistakes committed by me/ us in performance of my / our professional obligations and shall be binding on me/us and our legal and personal representatives, successors and assigns.

Also in “Declaration From Valuers” it is asked to submit that:-

“f. I have read the Handbook on Policy, Standards, and procedure for Real Estate Valuation, 2011 of the IBA and this report is in conformity to the “Standards” enshrined for valuation in the Part-B of the above handbook to the best of my ability.”

“g. I have read the International Valuation Standards (IVS) and the report submitted to the Bank for the respective asset class is in conformity to the “Standards” as enshrined for valuation in the IVS in “General Standards” and “Asset Standards” as applicable.”

He added Though it is the duty of the empaneled valuer to carry out the assignment Valuation Report in a fair manner because on the basis of his report bank has to decide the amount of loan to give to a client, the following points must also be kept in mind:

-

The valuation report is on a particular date and may vary significantly due to changes in circumstances, such as communal riots in the area, endemic like corona or many other such factors.

-

It is not possible for the valuers to find authenticated sources of market value in India in the present circumstances when a large chunk of black money is transacted in real estate dealing

-

Under such circumstances, his valuation report may become defunct, without any misrepresentation of bad intentions of a valuer

-

The value of a property is also changed by the method of valuation adopted

-

Though the bank authorities who relied on the valuation report of the valuer do not have expertise in valuation, they also verify and check the contents of the valuation report at the time of the mortgage.

-

Hence the valuer should not be held responsible for at the time of NPA if the value of the property changes drastically due to reasons beyond his control.

Further, he would like to state that these conditions are not existing in the information given below and as such we would request you to refrain from asking for such Indemnity.

-

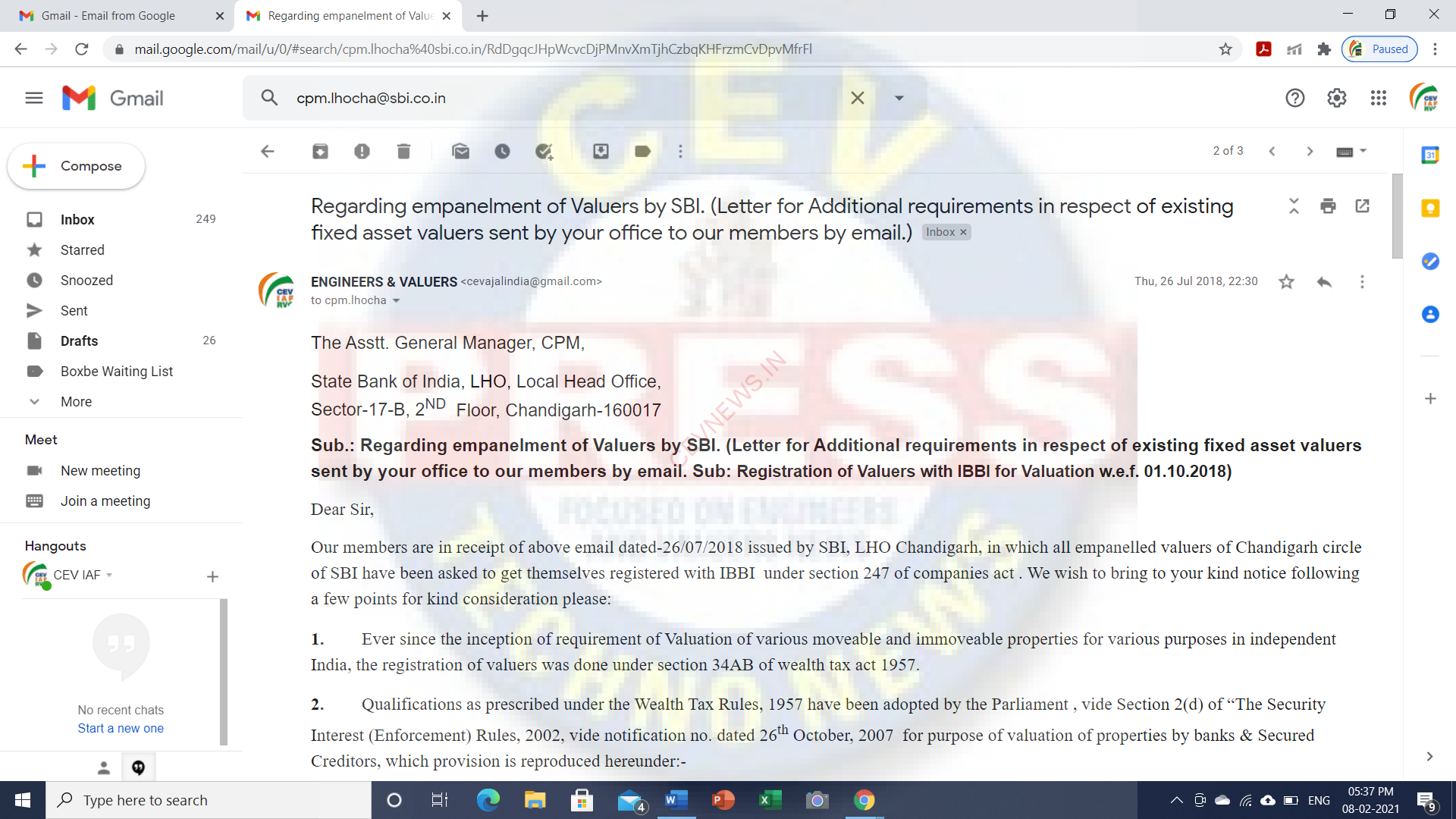

Special Significance has been given on the registration of Valuers under the provisions of Wealth Tax Act, 1957, Section 34 AB of Government of India, Ministry of Finance, Department of Revenue, Central Board of Direct Taxes under which the Valuers have been empaneled. However, no such condition of signing of an indemnity bond for empanelment as Valuer was stated in the Act.

-

Further, the condition of the signing of an indemnity bond to be on the Valuer’s panel of the bank was waived/removed as per the “Hand BOOK on Policy, Standards and Procedures for Real Estate Valuation By Banks & HFIs in India” issued by Indian Banking Association in February 2011, and supported by NHB, Page No. 31 PART A – POLICY Point No. 1.9 – Obligations of the Banks / HFCs which reads – “No security deposit or any other indemnity money i.e. indemnity bond should be taken from the Valuers as security for the professional services that they provide” This is in line with the practice with other professionals like Advocate, Doctors, Engineers, Chartered Accountant, etc from whom no such indemnity or Security is demanded.

Banks have also confirmed this from the conditions for empanelment that the Valuer also undertakes that he/ she/ it is/ are fully aware of the latest Handbook on Policy, Standards and Procedure for Real Estate Valuation of the IBA and the reports to be furnished to the SBI shall be fully in conformity with the standards enshrined for valuation in the same.

-

According to the “Report of the Group constituted by the Department Of Financial Services, Ministry Of Finance, and Government of India to Standardize Procedures for Valuation of Assets”. – Page No. 31 handwritten on top right/ Page No. 19 of the report Pt. 3.2.7 –Obligations of the banks which reads out – “No security deposits or any other indemnity money i.e. Indemnity Bond shall be taken from the Valuers as security deposit professional services they provide.” It has been emphasized on no Security Deposits or any other Indemnity Money (i.e. indemnity bond) should be taken from the Valuers as Security for the Professional Services relating to valuation rendered by them.

-

Also as per Company’s Act, 2013, Chapter No. XVII- Registered Valuers, nothing has been mentioned about signing an Indemnity Bond for getting registered with the Ministry of Corporate Affairs.

-

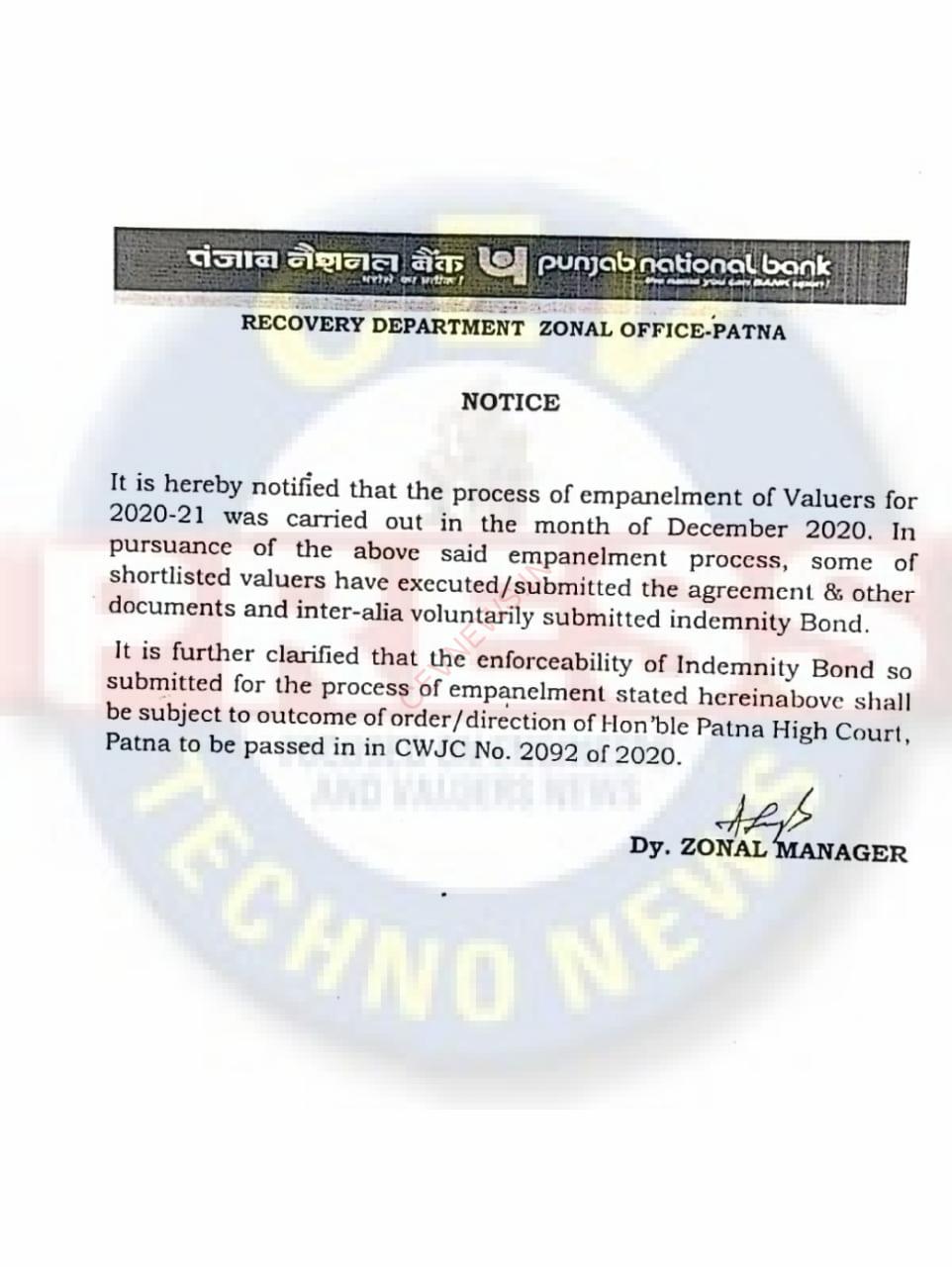

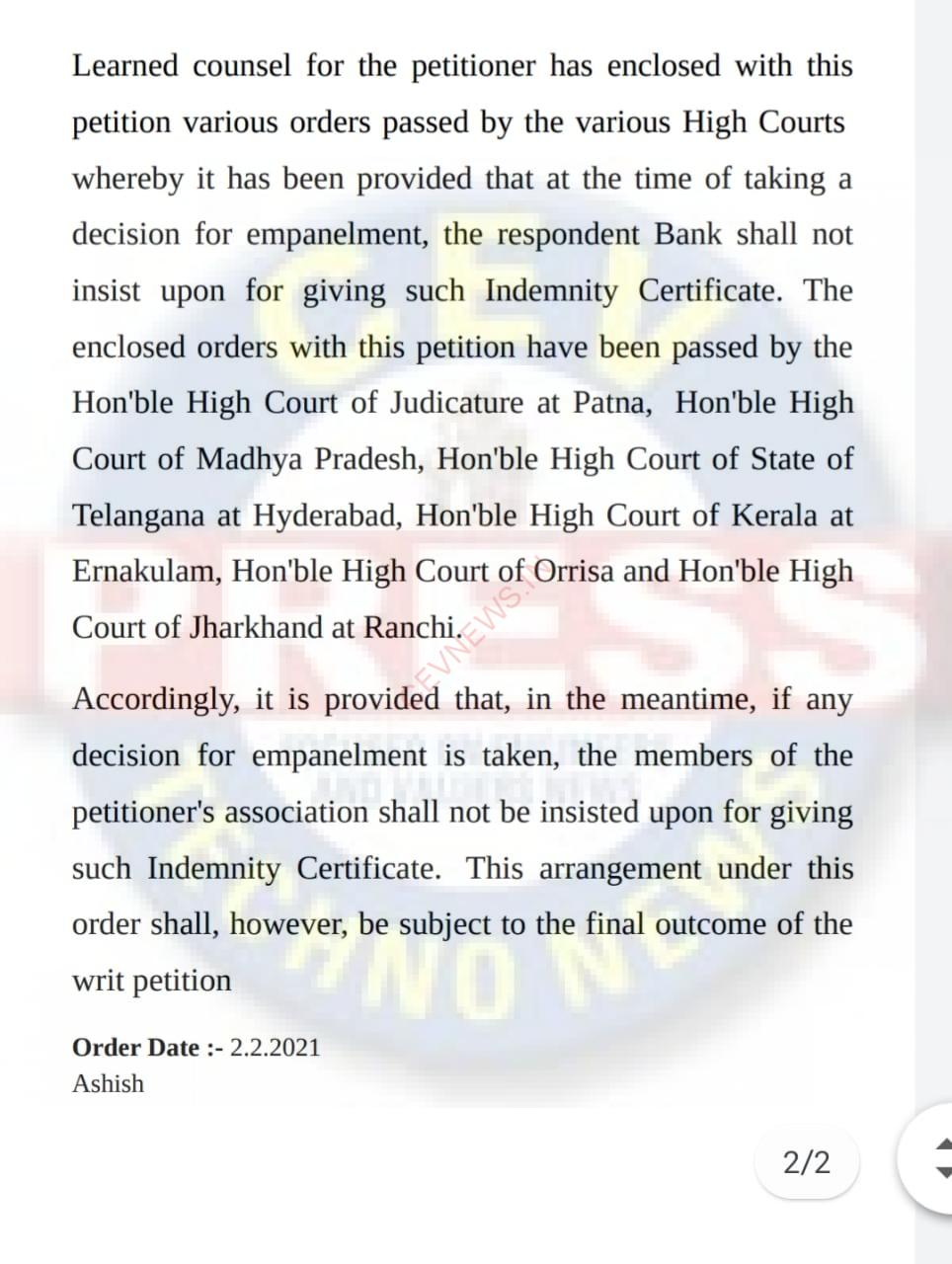

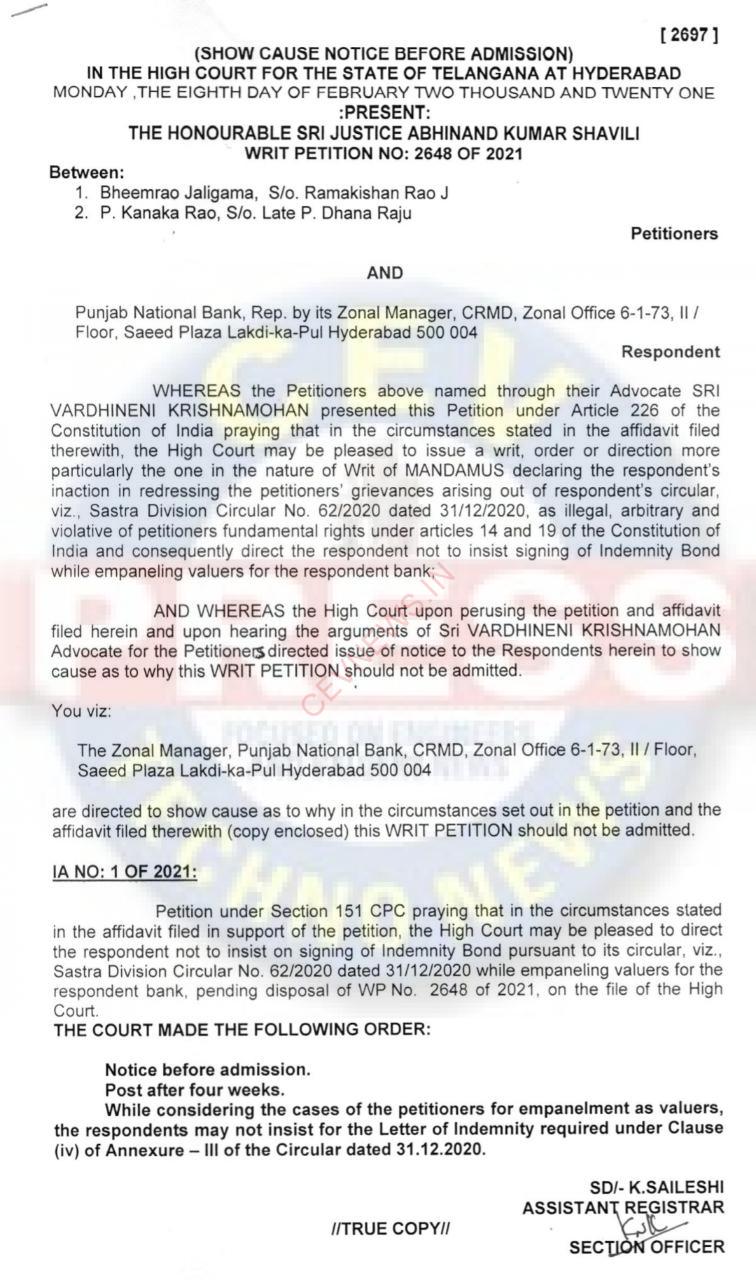

The Patna High Court Order dated 31st January 2020 states that no Indemnity be asked from the Valuers. In the meantime, if at all any decision for empanelment is taken, the petitioners shall not be insisted upon for giving such indemnity certificate. However, this order will be subject to the outcome of the writ petition.

-

Further banks have stated that while conducting the valuation, valuers have to comply with the International Valuation Standards (IVS) as applicable to the respective class of asset and respective method of valuation. These standards may not be applicable in Indian conditions for the reasons explained in the paras above.

The only remedy lies in laying down valuation standards as per Indian condition and prepare valuation format according to these standards so that there is no chance any misgivings by the valuer or anyone else to modify the valuation report according to whims and fancies of a client or bank.

Therefore, we hereby kindly request all banks to look into the matter and arrange the waiving off signing an indemnity bond for empanelment as Valuers with Zonal offices all over India.

Banks are also requested to please look into the matter of applications of those persons who are left out because their applications were not forwarded by Branch/Zonal offices and in further empanelment processes you are requested to allow candidates to send their applications directly to Circle offices to avoid any missing and mishandling & delay in forwarding & sending (due to pick & choose a policy of some officer to favour any person) of important documents by branch officers.

LETTER TO PNB Dt-06/01/2021

LETTER TO SBI Dt-07/06/2020 followed by email on 16/06/2020

LETTER TO HON. PMO Dt-01/11/2019

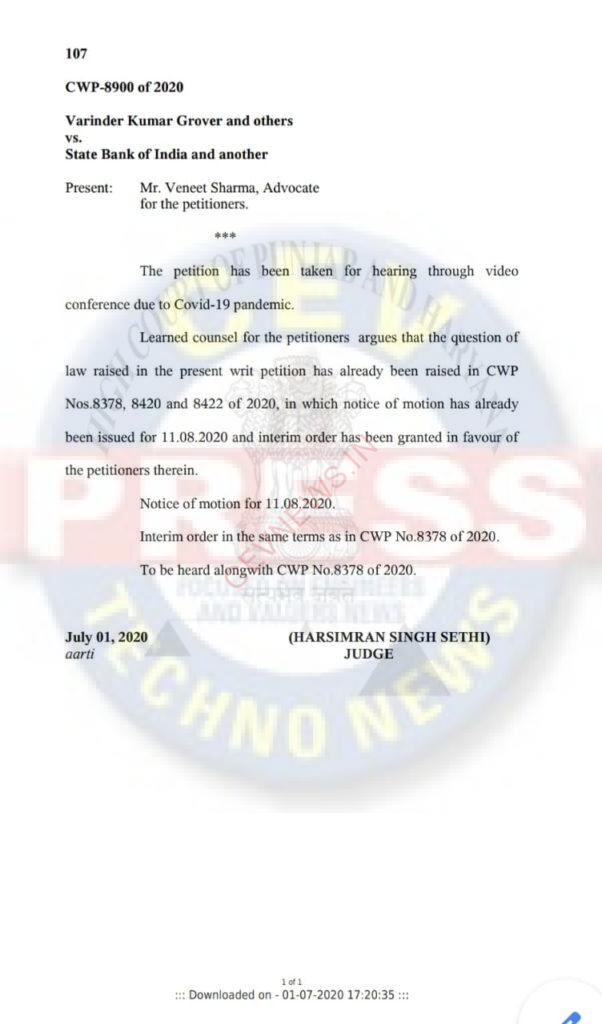

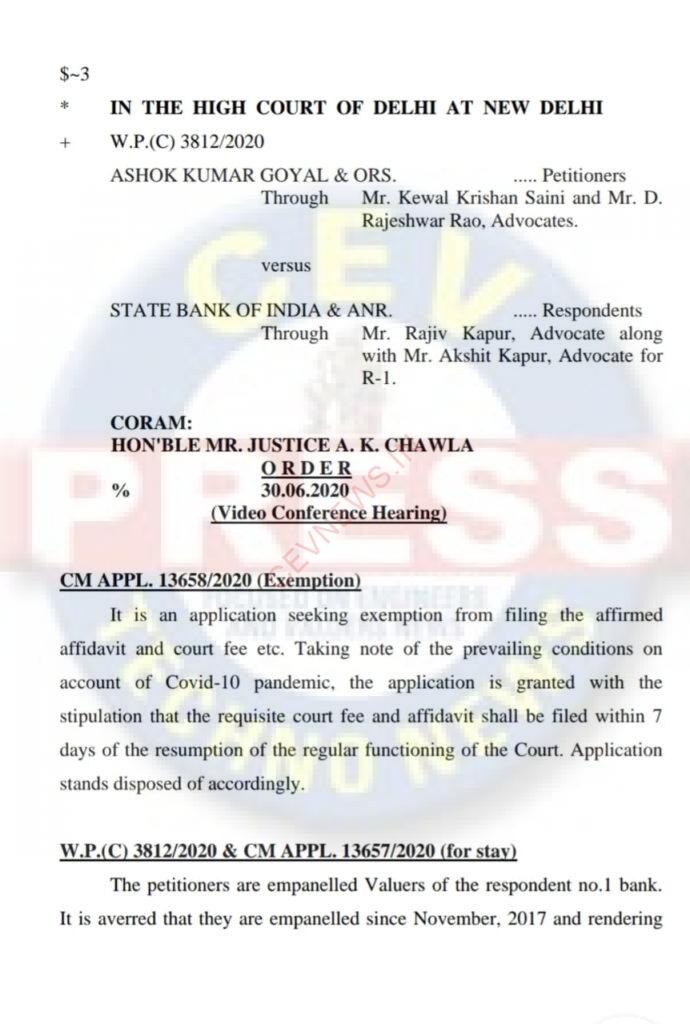

He further added that various Hon. High Courts including Hon.Patna High Court, Hon. UP High Court, Hon. Punjab & Haryana High Court, etc., have already issued Stay orders against SBI in the similar conditions. Then Why PNB has stipulated the same conditions again and can’t it be treated as contempt of court.

STAY ORDER HON. PATNA HIGH COURT

https://drive.google.com/drive/folders/1XB1QcYgCCjCRZcc04K0xmmTecDZwz5Gz